In an environment where community needs are greater than ever, it is essential for nonprofits and public service programs to prioritize growing their portfolios to expand impact and support long-term sustainability. Thoughtful investment program management can help increase assets, strengthen long-term giving, and reinforce positive relationships with fundholders. Fortunately, there are practical strategies that FEG believes can help increase donor engagement, optimize use of donor funds in the portfolio, and strengthen relationships with local advisors.

Amid uncertainty around federal funding cuts and growing needs from the community, maintaining positive relationships and transparent communication with donors is paramount to the success of community foundations. In our work, we have observed three practical strategies that meaningfully strengthen donor relationships and improve future contributions:

- Increase engagement with donors

- Align portfolio investment options with donor desires

- Expand externally-managed funds (EMFs) to tap into local advisor networks

As is often the case, getting the details right can make all the difference.

Strengthen Donor Engagement with the Portfolio

By increasing engagement with donors, foundations can help strengthen relationships and grow donor assets. Proactively communicating details about the investment program can help build trust and ease concerns well before they become pain points, while also better managing donors’ expectations.

Consider a question from a donor as to why a foundation’s portfolio and its returns look different than their individual investments. Absent clear communication, the differences in rationale and investment objective are not always fully understood. If, however, portfolio information is proactively communicated, donors benefit from a detailed understanding of portfolio strategy, asset allocation, and investment philosophy. Trust is enhanced, understanding is increased, and future donations are made with a new confidence – and perhaps increased as a result.

In-person events, email updates, educational blogs, and short videos can all be used to keep donors informed about portfolios and markets. Some foundations co-host quarterly webinars with their investment advisor, drawing as many as 100 participants. Webinars provide a valuable opportunity to engage, ask questions, and address concerns. Additionally, the advisor will sometimes have 1:1 meetings with key donors to address their specific issues and needs.

A critical component to increased engagement is “knowing your audience.” While some donors may be investment experts with decades of experience, others may have little investment knowledge. The insights and information shared should be aligned with their specific level of investment expertise. There is absolutely nothing wrong with addressing complex investment concepts, but walking audiences through each step can help increase comprehension and therefore engagement.

Establishing a formal plan to proactively communicate with donors during significant market events (such as a rapid market correction or an unexpected policy change) can also be beneficial. While the investment message is often “stay the course,” easing donor concerns in real time can be a powerful way to build and maintain trust. With all investment program communications, FEG recommends foundations lean on their investment advisor to collaborate and provide insights and commentary. Holding a meeting between development staff and the advisor can uncover needs and create a valuable feedback loop to continually improve donor engagement.

Transparency, frequent communication, and a demonstrated ability to position current events and market conditions with the perpetual time horizon of an endowment portfolio can help reassure and give confidence to donors, often when it is needed most. These actions can positively influence existing donors to increase their gifts and help new donors make the decision to give.

Align Portfolios with Donor Desires

If a foundation can align their investment options with their donors’ wishes they may be more likely to keep—and potentially increase—their investments with the foundation. It is important to remember, however, that not all donors are looking for the same solution.

Foundation staff know their donors and communities best. The question should be asked, what are donors looking for in gifting options, and are those needs being met? Portfolio options can differ widely—across time horizons, types of investments, and values alignment—including:

- Portfolios with long-term (more than 7 years), intermediate-term (3-7 years), and short-term (less than 3 years) time horizons. For example, an agency fund keeps 50% of their assets in the long-term portfolio, 30% in the intermediate-term portfolio, and 20% in the short-term portfolio.

- Stand-alone equity and fixed income portfolios that allow a donor to customize their own portfolio from both. For example, a donor allocates 75% to the equity portfolio and 25% to fixed income.

- Impact and values-based approaches such as ESG, MRI/PRI, SRI, and faith-based portfolios. For example, a donor allocates 100% of their donation to the impact fund.

Foundations differ on whether to allocate to impact portfolios separately or integrate them into a long-term pool. There is not one right approach, but in both models, it helps to think about each step—from ideation to manager selection to implementation and ongoing evaluation—as part of a holistic process with clear objectives and success measures. According to FEG’s 2025 Community Foundation Survey, three-quarters of respondents incorporating responsible investing strategies offer separate sleeves to meet diverse donor needs. This pragmatic approach can also help unify differing perspectives among boards and investment committees.1

(The survey highlights a range of useful data points on responsible investing, EMFs and other issues important to foundations today. Check out the webinar.)

As menu options are considered and designed, it is imperative to keep the big picture in mind. More solutions can be beneficial—to a point. The balance between adding breadth and avoiding unnecessary complexity—and the associated expense that comes with it—is important to get right. Working closely with the investment advisor and investment/finance committee, especially as assets grow, can help manage overall risk and return, and avoid unnecessary complexity.

Expand Externally-Managed Funds (EMFs) to Tap into Local Networks

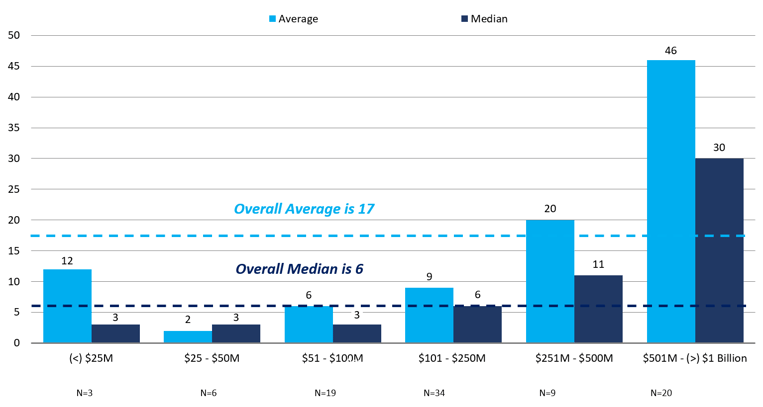

The use of externally-managed funds continues to expand, and for good reason. Local advisors serving as educators—and by extension, advocates—of the community foundation can directly aid fundraising. Here again, FEG’s 2025 Community Foundation Survey provides insight. It revealed that community foundations with existing EMF programs had an average of 17 funds, with a notable difference between small and larger foundations.

Larger Foundations Utilize External Managers to a Greater Degree

Number of External Managers by Foundation Size

Data Source: 2025 FEG Community Foundation Survey

A key consideration is investment minimums, which range from $100,000 to $2,000,000, with a median of $500,000. While lowering EMF minimums can attract more donors, many foundations report administrative costs rising sharply once thresholds dip below $250,000. As with portfolio choice, it is important to find the right balance for each specific situation.

Another concern with increasing externally managed funds is the drain on staff to monitor and report on each fund. This can be mitigated by utilizing the foundation’s investment advisor to oversee all externally managed funds. The investment advisor likely will have the experience and the technology needed to evaluate managers initially, create reports, and conduct ongoing due diligence.

Optimize Donor Assets, Strengthening Ties

Drawing on decades of work with community foundations, we have seen firsthand how thoughtful investment programs can strengthen donor relationships and help organizations fund essential tasks—and therefore persevere through the inevitable challenges that arise. Ask yourself:

- Does your foundation have a donor communication plan that keeps donors informed on a regular basis, and provides necessary context for market surprises? Further, does your approach reflect the audience’s level of understanding and engagement?

- Does your foundation have collaboration between development and finance staff, the finance/investment committee, and the investment advisor?

- Does your menu of portfolio options reflect donor values and priorities?

- Could expanding your EMF program open up opportunities to bring in more assets?

- Is there a right balance between your portfolio choices, EMF minimums, and your administrative efficiency?

Footnotes

12025 FEG Community Foundation Survey. This data includes responses from 53 of the 113 U.S. community foundation participants.

Disclosures

This information was prepared by Fund Evaluation Group, LLC (FEG), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directed to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202 Attention: Compliance Department.

The Community Foundations data is obtained from the proprietary FEG 2025 Community Foundation Survey. The study includes a survey of 113 U.S. Community Foundations. The survey was open for responses online from January 15 - March 7, 2025. Participants did not pay to be included in the survey. Participants also had the option to complete as a word document and email the results back to FEG. The data from this survey was grouped into between five and seven categories based on assets of the community foundation with assets ranging from less than $25 million to greater than $1 billion. The information in this study is based on the responses provided by the participants and is meant for illustration and educational purposes only.

This information is prepared for informational purposes only. It does not address specific investment objectives, or the financial situation and the particular needs of any person who may receive this presentation. Neither the information nor any opinion expressed in this report constitutes an offer, or an invitation to make an offer, to buy or sell any securities.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this presentation is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it.

Any return expectations provided are not intended as, and must not be regarded as, a representation, warranty or prediction that the investment will achieve any particular rate of return over any particular time-period or those investors will not incur losses.