After a period of exuberance in 2021, the tide turned in private markets. What began as an avalanche of capital into private equity and venture funds has given way to a more measured, cautious environment. Meanwhile, public equities corrected sharply in 2022 but quickly rebounded to new highs.

This divergence highlights one of the core differences between the two worlds: liquidity. Price discovery in public markets happens instantly. Private valuations, however, only reset through negotiated transactions—and those have been limited in recent years.

The Repricing Gap

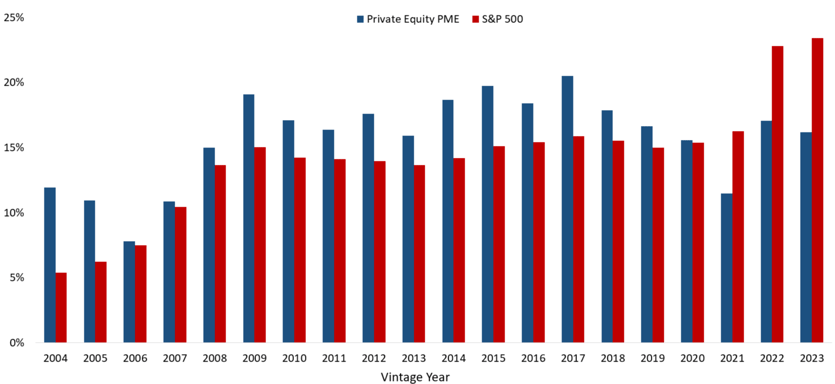

The market rally in public equities has generated exceptional performance over the past three years. Still, the clearing of the private equity markets has led to a dearth of distributions, weighing on private equity returns. This performance has not been the historical norm, as buyout equity consistently outperformed the S&P 500 Index before 2021. In the more heavily whipsawed venture capital (VC) markets, substantial outperformance against the public market has ebbed and flowed, but recent weakness has left VC three-year horizon internal rates of return (IRRs) negative through 2024. The discrepancy reflects how private capital has lagged in both revaluation and recovery.

Buyout's Recent Weakness Against The S&P 500 Index Has Not Been The Norm

Private Equity (Buyout) Public Market Equivalent vs. S&P 500 Index by Vintage Year

Data Source: Pitchbook

Data as of December 31, 2024.

With exits and deal activity still subdued, private strategies have not yet caught up to their public counterparts. But this lag also creates opportunity. A record 12,500 private equity–backed companies now populate the U.S. market—three times the number of public listings. That growing “inventory” of private firms is a fertile hunting ground for disciplined investors.

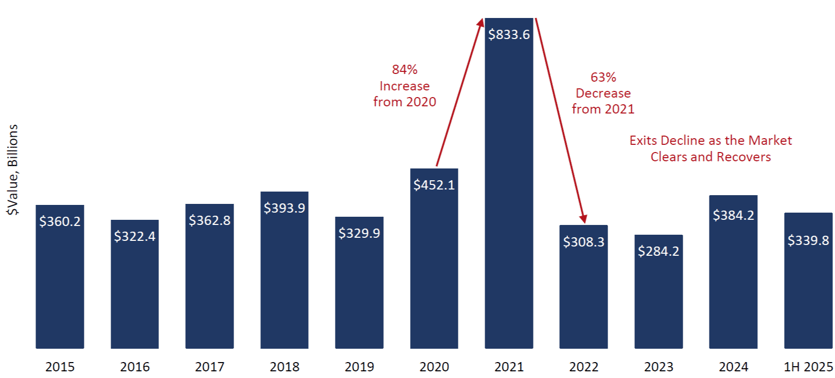

A Gradual Recovery

The clearing process in private markets will continue to take time. In venture capital, one-year IRRs turned positive again in late 2024, largely thanks to surging investment in artificial intelligence (AI) startups. Buyout funds—typically anchored in more stable business models—have begun to normalize faster. Exit activity, which experienced an unsustainable surge of over 80% fell by more than 60% from its 2021 peak and has returned toward sustainable levels, while the median holding period for exited companies decreased from seven to six years in 2025. We expect conditions to continue improving, but the process will be gradual.

Private Equity Exit Activity Dropped Substantially After An Unsustainable Spike

U.S. Private Equity Exit Activity Value, $Billions

Data Source: FEG; Pitchbook

Data as of June 30, 2025.

At the same time, deal activity is picking up, with several large deals indicating an improving market. Add-on acquisitions now account for over 75% of buyout deals, signaling managers’ focus on strengthening existing portfolio companies for future sale.

The Silver Lining: Improved Terms for Investors

For private capital investors, the last few years have been defined by weaker distributions. Cash flows to limited partners (LPs) declined to levels not seen since the Global Financial Crisis, dipping below 8% of net asset value before improving modestly.

Fundraising has also cooled dramatically. Venture capital funds are pacing for their weakest year in a decade, while buyout fundraising remains concentrated among the most established managers.

The scarcity of capital, however, has a silver lining: general partners (GPs) are adjusting their approach, AI is fueling a new venture wave, and most importantly, private markets are offering improved terms for new investors and less competition for deals.

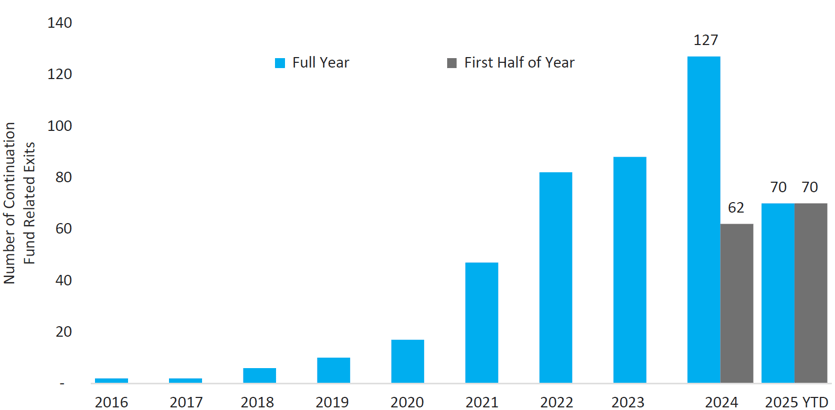

GPs Adjust

In response to muted exits, managers have increasingly relied on secondary markets, partial realizations, and continuation funds. These tools, once niche, are now helping to improve private market liquidity.

- Partial realizations (selling portions of holdings) have climbed sharply since 2019.

- Secondaries provide earlier liquidity and more pricing transparency, helping recycle capital efficiently.

- Continuation funds let LPs either cash out or roll forward into new vehicles, while allowing GPs to hold onto prized assets longer to continue building value.

Continuation Funds Provide Optionality To Limited Partners

Private Equity Continuation Fund-Related Exit Activity

Data Source: Pitchbook

Data as of June 30, 2025.

Note: Data includes North America and Europe

Together, these mechanisms mark a structural shift: private markets are slowly becoming more flexible and dynamic in how capital circulates.

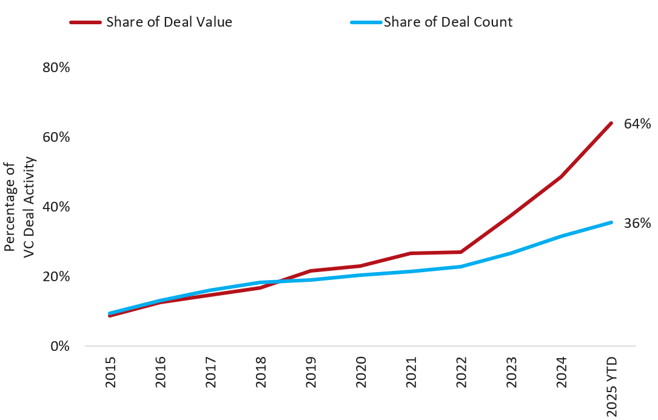

AI Fuels a New Venture Wave

AI is not only a story about the largest mega-cap technology-related companies; it is also attracting capital to the VC space. Venture deal activity in AI and machine learning surged again in 2025, representing over a third of all VC deal value. From healthcare and finance to enterprise software, AI’s reach has sparked renewed optimism, and potentially, the next major cycle of exits and IPOs.

Optimism Surrounding Artificial Intelligence Is Breeding Venture Deals

AI & ML Deal Activity as a Share of U.S. VC Deal Activity

Data Source: Pitchbook

Data as of June 30, 2025.

Note: Artificial Intelligence (AI) and Machine Learning (ML)

The Road Ahead: Opportunity Through Discipline

Private markets are emerging from a challenging stretch stronger and, in some respects, fairer for investors. With less abundant capital, valuations are resetting at more sustainable levels, and deal terms increasingly favor investors over founders—a notable reversal from the frothy environment of 2021.

The adjustment is not over. It will take more time for activity and distributions to return to long-term norms. But for patient allocators, the opportunity may offer a potentially prime entry point. Scarcity is restoring balance, discipline, and better pricing power.

As the private landscape stabilizes, FEG believes investors who stay the course, maintain diversification, and commit steadily through this transition are poised to benefit from a market regaining its equilibrium.

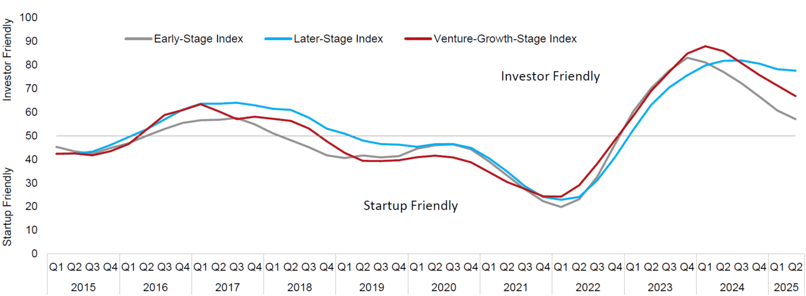

Private Equity Market Favors Investors Over Founders

U.S. Venture Capital Dealmaking Indicator

Data Source: Pitchbook

Data as of June 30, 2025.

Note: The dealmaking indicator measures dividend catch-up policies, liquidation preference, anti-dilution terms, voting rights, and valuation step-ups.

In Conclusion, public markets may have led the recovery and posted premium returns over the past few years, but private markets are doing what markets do: adapting and strengthening. For those willing to trade liquidity for long-term opportunity, this transitional period may not represent a setback, but a premium opportunity in disguise.

DISCLOSURES

This information was prepared by Fund Evaluation Group, LLC (FEG), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directed to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202 Attention: Compliance Department.

This information is prepared for informational purposes only. It does not address specific investment objectives, or the financial situation and the particular needs of any person who may receive this presentation. Neither the information nor any opinion expressed in this report constitutes an offer, or an invitation to make an offer, to buy or sell any securities.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this presentation is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it.

Any return expectations provided are not intended as, and must not be regarded as, a representation, warranty or prediction that the investment will achieve any particular rate of return over any particular time-period or those investors will not incur losses.

Index performance results do not represent any managed portfolio returns. An investor cannot invest directly in a presented index, as an investment vehicle replicating an index would be required. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.