In Brief

- Clarify mission alignment: Implementing a diverse manager program begins with defining how the program supports your organization’s mission.

- Develop a tailored strategy: Assess your current portfolio composition, set objectives, and choose the right structure—whether a dedicated sleeve, thematic lens, or integrated approach.

- Commit to ongoing management: Monitor progress through clear metrics, update policies and reporting, and evolve allocations to ensure accountability and lasting impact.

Asset owners place emphasis on aligning their portfolios with their values, including prioritizing diversity among those who manage their investments. They look at how their total portfolio can advance their mission in the communities where they operate and among the populations they serve. Examples include allocating capital to emerging minority-owned and operated managers or investing in private impact strategies that promote economic growth through job creation.

In this article, we outline the steps for implementing a diverse manager program. Whether your organization is incorporating diversity into a portion of the portfolio, applying it across all investments, or developing an impact solution, FEG can serve as a valuable resource throughout the process.

FEG and Diversity

At FEG, we know that diverse thinkers, backgrounds, and ideas matter—to our clients, our firm, and the broader community. We share the conviction of our clients such as community foundations, family offices, and charitable organizations that inclusive practices can lead to stronger, more sustainable outcomes.

Within our own culture, we take pride in fostering respect and excellence. We believe that diverse teams outperform homogenous ones. Furthermore, we believe an inclusive environment fosters a happier, more connected workforce, which ultimately leads to better outcomes.

We recognize that these values are also important to our clients. We have seen growth in conversations related to diverse managers from varying client types, including community foundations, family offices, and charitable organizations.

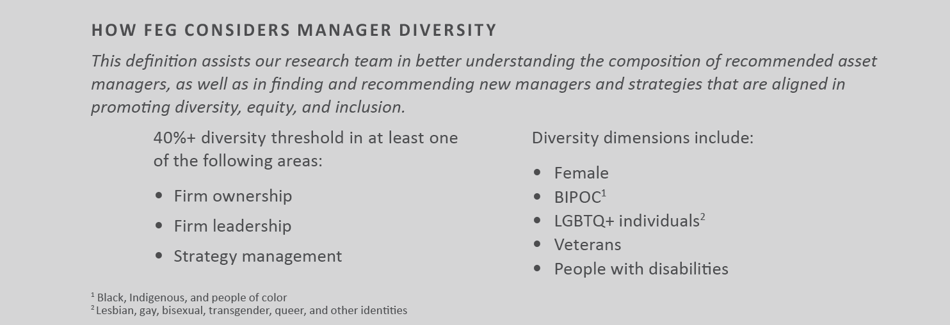

To put these beliefs into practice, FEG established a Diverse Manager Committee to track, evaluate, and disclose our efforts. Because the industry lacks a standard definition of diversity, the committee also developed FEG’s own framework for assessing asset managers, ensuring we remain purposeful about inclusion.

Part 1: Setting Objectives—The Discovery Process

What is Your Mission?

The first step is to clarify how a diverse manager program connects to your organization’s mission. Does your mission explicitly address social gaps, such as advancing gender or underrepresentation issues? Have you considered how investment actions—including manager selection—can reinforce those goals? Even if your mission statement does not currently include this language, strategic adaptations can allow for diversity considerations without risking “mission creep.” Defining your objective at the outset is essential to successfully implementing a diverse manager program as a fiduciary.

Find Common Ground

The first step in implementation is often the most challenging: finding common ground. Do the investment committee, staff, and board members agree that diversity and other social impact goals should be considered in the investment process? If so, what criteria should be prioritized?

FEG can help align interests and outcomes—for example, helping an organization clarify its definition of diversity—and ensure the portfolio reflects those priorities. To assist, we provide clients with an internal online survey focused on diversity and social impact considerations. Committee, staff, and board members can complete it individually; responses are recorded anonymously, then aggregated for an advisor-led debriefing to determine where common ground lies.

Give Yourself Permission

Once alignment is established, the next step is to update the organization’s investment policy statement (IPS) to include the agreed-upon language. This may involve incorporating allocations to diverse managers or social impact solutions, while staying consistent with other investment objectives.

Part 2: Developing Strategy

Know Who is Managing Your Investment Portfolio and What is Inside

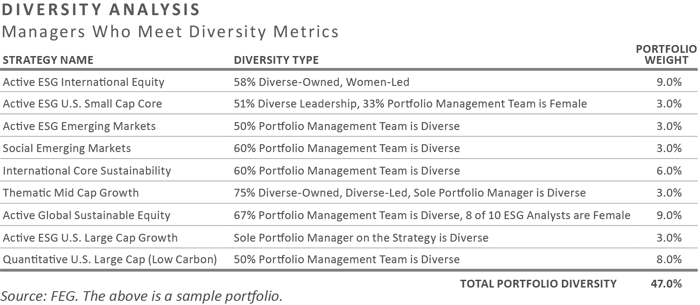

Before making significant changes to your portfolio, it is important to understand your portfolio’s current manager and strategy composition. Leveraging the expertise of FEG’s research team and Diverse Manager Committee, we can assess diversity within a portfolio using either your organization’s definition or FEG’s framework. From there, we help you create a practical timeline for implementation.

Part 3: Implementation

Portfolio Construction

There are many ways to incorporate diverse managers into a portfolio:

- Build an entire portfolio populated with diverse-owned or diverse-led firms or diverse-managed strategies.

- Set a clear target, by percentage or dollar amount, for allocations to diverse managers.

- Create a dedicated “sleeve” or silo within the portfolio focused on diverse managers.

- Apply a thematic lens, such as gender equity or racial justice, across the entire portfolio or within a portion of it.

- Invest in impact strategies that directly support underrepresented communities.

- Take an opportunistic approach, considering diverse manager opportunities as they arise.

- Take a “Rooney Rule” approach. Originally implemented in the National Football League, this rule requires at least one woman and one underrepresented minority to be considered in the slate of candidates for every open position. In this case, your approach would require that each manager search include at least one diverse-owned, -led, or -managed candidate.

An important question is whether your organization has a timeline or end goal for achieving its target level of diversity. FEG can work with you to design a customized restructuring plan that reflects your objectives and ensures accountability in the implementation process.

Part 4: Ongoing Management

Monitoring

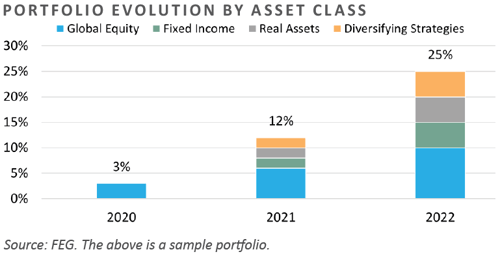

Implementing a diverse manager program takes time. FEG can help monitor your portfolio’s progress and provide formal updates on how you are advancing toward your diversity goals, both in terms of who is managing the portfolio and the strategies represented within it.

One example of a progress update is a breakdown of diversity metrics by asset class, showing each area’s contribution to the overall portfolio. By making incremental changes to the portfolio over time, organizations can meaningfully increase diversity across the portfolio.

For an update on a portfolio’s progress, we can assess the portfolio in terms of diversity KPIs, delivering an annual report or reports on demand.

Taking the First Step

FEG recognizes this is a journey, and all too often there is a desire to make changes immediately. However, the first step is often the most challenging. While the process may seem daunting at first, it quickly becomes more manageable once it begins. That initial step is the most important, as it marks the start of aligning an organization’s investments with its mission and priorities.

Implementing a diverse manager program follows the same principles as other portfolio construction processes: a targeted, thoughtful, and methodical approach. FEG is here every step of the way to answer questions and support your organization throughout the process.

DISCLOSURES

This report was prepared by FEG (also known as Fund Evaluation Group, LLC), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directly to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202, Attention: Compliance Department.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it. FEG, its affiliates, directors, officers, employees, employee benefit programs and client accounts may have a long position in any securities of issuers discussed in this report.

Neither the information nor any opinion expressed in this report constitutes an offer, or an invitation to make an offer, to buy or sell any securities.

Past performance is not indicative of future results.

This report is prepared for informational purposes only. It does not address specific investment objectives, or the financial situation and the particular needs of any person who may receive this report.

Edited November 2025.