Patience: Acknowledge and Adapt to Market Cycles

Biotech has a long history of growth and contraction cycles, and of investor optimism and pessimism. While transformative breakthroughs have emerged in the past half‑decade, investor enthusiasm cooled quickly after pandemic relief. After initial valuations surged on promise alone, a correction set in. Since its peak in February 2021, the S&P Biotech Index has fallen by more than 45%, and lagged the S&P 500 Index by more than 100% over the 5-year period ending June 30, 2025. Many early‑stage IPOs that capitalized on COVID‑era optimism ended up trading below their cash values – a common occurrence in periods of speculative fervor. Nonetheless, FEG believes the sector is far from broken; rather, it has reset. Still, while counseling investors to take a long-term view is preferred, this perspective is even more important when it comes to investing in biotech opportunities.

Experience: Navigate the Landscape

The most profitable path for biotech firms and their investors is often to focus and invest where science and technology can address unmet needs, rather than crowd into areas more likely to be solved by existing players who may have legacy advantages.

This level of specialty knowledge favors managers that focus solely on the biotech sector and, as a result, have the deep foundational coverage to look beyond headlines and current balance sheets. Whether investing in long-only or hedge fund strategies, smaller-cap publicly traded companies, or VC opportunities targeting new and innovative private companies, FEG views specialization and experience across biotech market cycles as essential.

Vigilance: Closely Monitor M&A and the Impact of Policy

Despite industry volatility, pharma giants continue to pursue mergers and acquisitions. With hundreds of billions of dollars in purchasing power and strong balance sheets, FEG believes biotech M&A to be robust in the coming years. While policy uncertainty has periodically roiled markets, price controls have been moderated, and efforts are underway to help ensure entrepreneurship and innovation are not stifled.

Investment across the biotech sector is uneven and there is less capital being invested in the sector overall. Still, emerging therapies for autoimmune diseases, early cancer detection via blood tests, and innovations in treating neurodegenerative disorders, to name a few, continue to be developed. While the past five years have been disappointing from an investment standpoint, we believe the case for more attractive opportunities over the next five is compelling.

A Large Universe of Public Opportunities

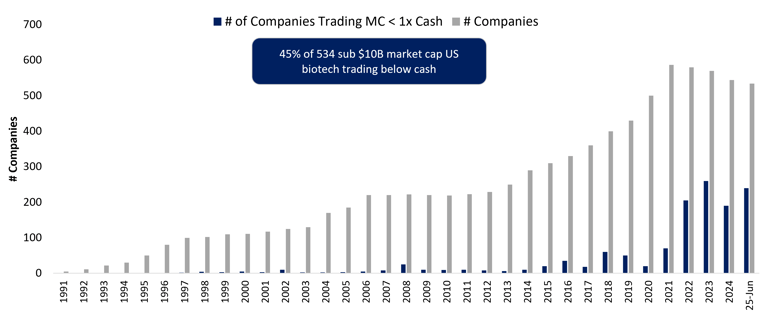

Number of Biotech Firms with Less Than $10 Billion Market Cap

Data Source: RTW Capital

As the chart above highlights, there is a large universe of publicly traded biotech firms, many of which trade at reasonable valuations. At the same time, science and innovation continue to have significant impact in both public and private markets. In a classic form of creative destruction, there will no doubt be winners and losers in this space. Opportunities may sometimes be narrow, but they are there. In such an environment, we seek to find active managers in biotech, and avoid indexing. Those managers with the experience and focus to understand the science, capital markets, business building, policy background and the broader pharma industry may be best positioned to leverage this environment and add value.

DISCLOSURES

This information was prepared by Fund Evaluation Group, LLC (FEG), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directed to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202 Attention: Compliance Department.

This information is prepared for informational purposes only. It does not address specific investment objectives, or the financial situation and the particular needs of any person who may receive this presentation. Neither the information nor any opinion expressed in this report constitutes an offer, or an invitation to make an offer, to buy or sell any securities.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this presentation is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it.

Any return expectations provided are not intended as, and must not be regarded as, a representation, warranty or prediction that the investment will achieve any particular rate of return over any particular time-period or those investors will not incur losses.

Index performance results do not represent any managed portfolio returns. An investor cannot invest directly in a presented index, as an investment vehicle replicating an index would be required. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.