Bitcoin, Blockchain, and the Question Asked at the End of Every Investment Presentation

For now, Satoshi may have disappeared into oblivion quickly after emerging as the mastermind of the world’s first digital currency, but the legacy of Satoshi’s work on the future of cybercurrency remains.

WHAT IS IT?

Bitcoin is a type of cryptocurrency built upon blockchain technology.

Cryptocurrencies are digital financial assets for which ownership and transfer of ownership is guaranteed by a cryptographic decentralized ledger that provides a record of transactions. The technology used for that ledger is blockchain, which is an ever-increasing record that expands as ledger blocks are chained together.

Paramount among the benefits of cryptocurrencies is their ability to reduce the cost of transferring funds, particularly on a global scale. They cut down on the need for trusted third parties to verify transactions, and give people around the world access to fast, cheap, and borderless payments. ¹

Introduction to Bitcoin

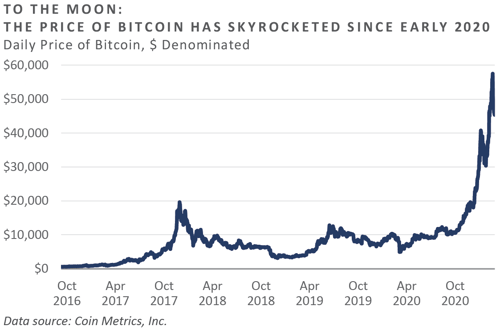

In the period following the Great Financial Crisis—the worst financial crisis since the Great Depression—this elusive, intangible, fast-growing asset allured investors. In just over a decade, Bitcoin has gained a cult-like following, accelerating the expansion of the entire cryptocurrency asset class. In July 2010, Bitcoin began trading at a value of $0.0008, climbing to $0.08 by month’s end. Bitcoin gained traction in the early 2010s, but its growth to $963 by the end of 2016 pales in comparison to the moves the currency would experience in subsequent years.² Bitcoin is not the only cryptocurrency in the market, but it certainly is the closest to being the household name in the space.

Widespread mainstream adoption of Bitcoin in 2017 served as a catalyst, skyrocketing prices to $18,940 by year-end. Since its inception, Bitcoin has weathered extreme volatility. Sensational price spikes have seemingly stagnated at times before propelling to new levels. In March 2020, the value dipped to $4,841, or 30% from the start of the year, but rallied to end the year over $29,400, a 323% year-over-year increase and a 507% rise from the March drop. Bitcoin’s ascent has continued in 2021, hitting a record high of $48,200 on February 9.³ Not surprisingly, Bitcoin’s rollercoaster of price fluctuations has led some investors to question their risk tolerance level.

Recent Investor Attention

Bitcoin is often touted as a replacement for gold, but can these intangible coins really be considered “digital gold?" Both gold and Bitcoin are in limited supply. They serve as mediums of exchange, as each can be traded for goods and services. Both meet the currency criteria of having units of account: gold can be divided into half ounces or quarter ounces, and Bitcoin can be partitioned to one Satoshi, which equals 1/100,000,000 Bitcoin.⁴

Although gold’s store of value is indisputable, the intrinsic value of Bitcoin is debatable. Typically, store of value refers to an asset people can rush to during economic turmoil because of its intrinsic physical value. However, because Bitcoin is intangible, it is not yet clear whether it can serve as a store of value. The answer will likely rest in the breadth and pace of the currency’s adoption. Over 100 years, the price of gold has risen from approximately $20 in January 1921 to approximately $1,800 in 2021. By comparison, the exponential growth of Bitcoin from $0.08 to well above $50,000 in the past 13 years has spurred a new era of widely accepted intangible currency.⁵

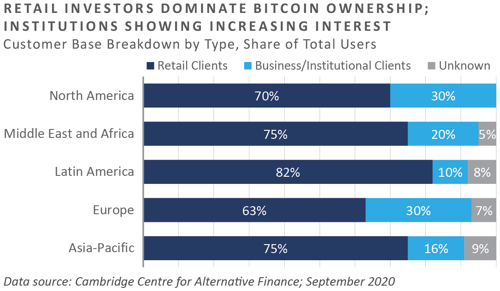

While retail investors still comprise the lion’s share of Bitcoin investors, several studies have reported a growing interest from institutional investors in cryptocurrency markets. For instance, a survey of American and European institutional investors conducted by Fidelity Digital Assets revealed that 36% of respondents had invested in cryptoassets and 60% believe that cryptoassets should form part of their portfolios.⁶

Though it may not yet be a defined sub-asset class in standard portfolios, a growing share of U.S. institutional investors have exposure to cryptoassets via the derivatives market.⁷ Despite the considerable development of institutional-grade financial instruments and infrastructure, the customer base for crypto-asset service providers is still primarily retail-driven, indicating that despite growing institutional interest, the conversion rate for institutional investors from expression of interest to investment remains limited.

Limitations and Risks of Bitcoin

The big question for many investors is: “How much risk does a potential investment in cryptocurrency entail?” While that can be challenging to estimate definitively, what we believe is most important is investors understand that cryptocurrencies, like any nascent asset, face a laundry list of downside risk. Investing in the underlying blockchain technology may help alleviate some of these risks of direct cryptocurrency positions, but first, we need to address those risks.

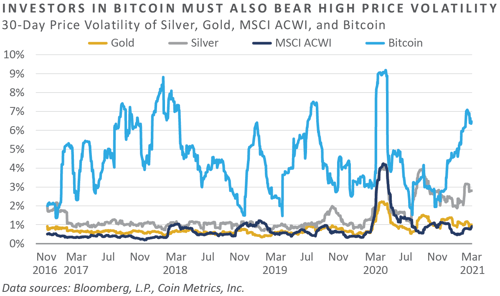

The volatility of cryptocurrencies is relatively extreme when compared with precious metals or the broader equity indices. The price of Bitcoin, for example, has experienced average annual price swings of 69%, while silver, gold, and stocks have averaged 27%, 13%, and 20%, respectively.⁸ Admittedly, the relative volatility of Bitcoin has fallen over time, but it can still be a prime example of the systematic volatility that exists in nascent coins. An institutional investor interested in including cryptocurrency in their portfolio would therefore need to have stakeholders and governance that can tolerate dramatic declines which can eclipse what many are accustomed to in the equity markets.

Regulation on a domestic and global scale stands to test the durability of crypto-currencies as they develop and become more mainstream. The idea of decentralized currencies running on peer-to-peer networks that central authorities are unable to control may pose a problem for regulators as they watch Bitcoin and other currencies gain steam in the modern economy. While this lack of potential manipulation is what makes Bitcoin and other cryptocurrencies so appealing to investors as a store of value, it is also what leaves the currencies vulnerable to aggressive regulation, should central governments feel their grip on monetary control slipping.

As of the publication of this report, regulatory agencies have been relatively supportive of cryptocurrencies, but investors must understand that the agenda of governments may evolve—and their degree of involvement may change—as adoption increases.

Coincidentally, in India, Reuters recently reported that a prospective law banning the mining, trading, and even possession of cryptocurrencies is expected to be introduced. Authorities are reportedly planning to promote blockchain while the Reserve Bank of India builds structure to support an official digital currency. For comparison, China has banned mining and trading, but not possession. As one might expect when authorities attempt a ban, the effort has triggered greater demand in India.⁹

Risks are not limited to volatility and regulation. Additional risks include capital efficiency, insurance and custody, security, and ESG considerations from Bitcoin mining.¹⁰ ¹¹

What about Blockchain?

While investors are curious about Bitcoin, many are still cautious about such an uncertain prospect. Those who want to take advantage of the boom in cryptocurrencies without the volatility may want to consider an alternative way to bet on the future of crypto without placing bets on single-name cryptocurrencies: investing in companies involved in the development and improvement of blockchain technology.

Cryptocurrencies are the first successful application of blockchain technology. Although the origins of blockchain can be traced back to 1991, the technology only became popular after the advent of Satoshi’s 2009 white paper on cryptocurrencies. In essence, blockchain is a computerized digital gateway that allows record transactions between two parties constantly and correctly, avoiding the need for middlemen and costly recordkeepers.¹²

The "blocks" in blockchain are chunks of data stored together. When a block is filled, it is "chained" to a new block, building a timeline of data that makes the information in the blockchain secure and non-fungible.¹³ The potential applications of this technology extend far beyond Bitcoin and cryptocurrency. Blockchain has the capacity to fundamentally alter the business landscape, especially for companies in industries such as financial services, healthcare, supply chain management, industrial products, and energy and utilities. With such a wide range of potential uses, the opportunities are vast.

Opportunity of Blockchain Technology

The possible utilizations of blockchain networks are immeasurable and complex, and although some may seem like a pipe dream, others—such as DeFi (decentralized finance), banking the unbanked, and web 3.0—have already proven to be promising solutions to long-standing global issues.

Perhaps the most notorious blockchain application is DeFi. Made popular through Bitcoin and Ether, DeFi is an umbrella term with an aim of disrupting traditional financial applications by eliminating the need for large banking institutions to serve as middlemen for transactions. By creating a decentralized ledger of transaction on a blockchain, financial transactions are confirmed by the broad peer-to-peer network, meaning any transaction—from paying for a meal at a restaurant to purchasing property or paying down debt—can be completed without the use of a middleman.

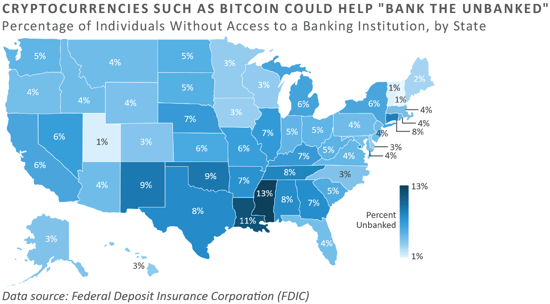

A bonus characteristic of DeFi is its ability to effectively “bank the unbanked.” In a technologically connected world, access to quick and efficient banking systems is crucial for participation in the global economy. However, according to the International Monetary Fund, as many as 1.7 billion people globally are unbanked or underbanked, meaning they do not have reliable access to an institution able to meet their financial needs.¹⁴ Additionally, according to the U.S. Department of Economic Inclusion, almost 9% of Americans were unbanked as of 2019. Blockchain aims to solve this problem by allowing individuals to access low-cost digital wallets that can be used to store currency, as well as exchange and borrow from both local and global participants.

Early adopters of Bitcoin and blockchain were predominantly fringe coders and techno-anarchists who saw the vast potential of the technology, so it is not surprising that blockchain has been touted as one of the major pieces of hardware that will make up the next generation of the internet. Proponents of web 3.0 argue that the infrastructure and centralized system of our current web 2.0 is inherently flawed in its architecture. The major issues of web 2.0—decentralized servers, large companies monitoring and dictating data, a host of digital security and safety issues—are expected to be in the past with the inception of web 3.0, in which a combination of AI, machine learning, Internet of Things (IoT), and blockchain technologies, among others, will come together to create a new inception of the internet.

Through exchange advancements over the past decade, cryptocurrencies have become increasingly easy and secure to trade in the active market. In contrast, investing in blockchain technology is not as simple and requires additional preparation and due diligence to implement.

Institutional Opportunity Set

Despite the inherent challenges due to the complexities of blockchain, investors have become increasingly allured by the opportunity to invest in what they believe to be the next generation of software infrastructure. There are two broad investable areas of blockchain technology: direct Bitcoin/token plays and the businesses that are developing and implementing new products that harness the potential of distributed ledger technology.¹⁵ Ways to participate in the vast development and adoption blockchain technology are abundant, and the various avenues of investment carry different risk-return profiles.

Institutional investors have the option to partner with investment managers with varying degrees of focus on the developing blockchain space. Strategies can be broad or specialized and niche, but all will share a similar ideology of sourcing and investing in companies focused on improving the underlying technology and streamlining the way in which businesses and individuals can utilize and implement blockchain technology into their functions. Institutions seeking exposure to blockchain technology may want to consider partnering with private equity managers that specialize in investing in these highly-complex technology companies during their early stages.

Conclusion

If one can be sure of anything in the next decade, it is that technology will continue to evolve and shift society. However, as investors, it is important to stay prudent. Whenever an asset appreciates 300%+, it will naturally garner the attention of the media and investors, but it is not possible to purchase past performance or predict the future, so investors must be cautious and intentional in their approach.

There is no way to know where Bitcoin will be in 20 years—it could very well be worth zero, or it could be the next global currency—the degree of institutional adoption and government regulation are likely to determine its fate. However, it would be foolish to ignore the fact that blockchain and cryptocurrencies are challenging the way people view long-standing institutions and practices, and that finding paths to responsibly participate in this revolution could be the next gold mine.

FOOTNOTES

³ https://investingnews.com/daily/tech-investing/blockchain-investing/bitcoin-price-history/

⁵ https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart

¹⁵ https://www.blockchain.com/

DISCLOSURES

This report was prepared by Fund Evaluation Group, LLC (FEG), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directed to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202 Attention: Compliance Department.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it. FEG, its affiliates, directors, officers, employees, employee benefit programs and client accounts may have a long position in any securities of issuers discussed in this report.

Neither the information nor any opinion expressed in this report constitutes an offer, or an invitation to make an offer, to buy or sell any securities.

Past performance is not indicative of future results.

This report is intended for informational purposes only. It does not address specific investment objectives, or the financial situation and the particular needs of any person who may receive this report.

FEG does not invest in or recommend crypto currency investments to its clients. This report should not be viewed as a recommendation to invest in crypto currencies.

Trading in crypto currencies involves significantly high volatility compared to traditional securities.

Crypto currencies are currently less regulated compared to traditional securities and other legal tender and involve a high degree of uncertainty, volatility and risk of price manipulation. Additionally, due to the electronic nature, there is cybersecurity risk involved in trading and maintaining crypto currencies.

Published March 2021