FEG is actively monitoring the impacts on markets and the global economy of Russia’s invasion of Ukraine. As the situation is quickly evolving, we will provide updates to FEG commentary, noting the date of each piece.

If you have any specific questions, please reach out to your FEG contact, or contact us here.

March 30, 2022

FEG FLASH POLL RESULTS

In FEG’s latest Flash Poll, we wanted to understand institutions’ actions surrounding Russian securities within portfolios and any related impacts on investment portfolios overall. While we only received 21 responses, there were some similar trends to call out. The majority of respondents (nearly 80%) believe that the institutions' boards and/or investment committees have the responsibility to determine whether to divest from securities.

Responses to the flash poll were received from 12 states. Of note, executive orders issued by governors mandating that public institutions divest from Russian securities have largely been issued to public universities and pension plans. Below is a snapshot of the state executive orders as of March 24.

- Only 13 states have a formal executive orders in place. Colorado was the first state to make an order on February 24.

- However, 32 states have made some kind of announcement related to divesting from Russia, or moving away from using Russian products (ex. liquor).

The interactive map below provides a quick view of states with, or without executive orders, and links to more detail. Please note, this map is best viewed from a desktop/laptop.

March 3, 2022

Removal of russia from msci and ftse russell indices

The escalation of the Russian invasion of Ukraine has rattled investors, and the negative impact on Russian securities has been acute. While the Russian exchange remained closed for a fourth consecutive day, several Russian companies – such as Sberbank, Gazprom, and Lukoil – trade on other exchanges through ADRs (American depositary receipt) and GDRs (global depositary receipt) and have realized precipitous declines in their share price this week. As a result, the London Stock Exchange suspended trading in 27 companies on Thursday, and index-providers MSCI and FTSE Russell announced the removal of Russia from their indices. The changes to MSCI indexes will be effective March 9, and FTSE Russell will be effective March 7.

As of January 31, Russia’s weight in the MSCI Emerging Markets Index was 3.3%. One month later, on February 28, it dropped to 1.6%. As of March 9, 2022, Russia will be 0%. The dramatic sell-off and decision to remove Russia from indexes reflect the conflict’s gravity. The impact of the sanctions imposed on Russia continues to develop, and investors are selling positions in Russia-linked equities whenever there is liquidity available and at any price. The word “uninvestable” was used by many market participants in MSCI’s consultation process on whether or not to remove Russia from indexes. Click here to read more from MSCI’s press release.

The significant declines and changes to indexes will have varied impacts on investors. Any passive investors who manage funds that track MSCI or FTSE Russell indexes that include Russia will seek to sell Russian securities from those funds to maintain their targeted tracking error to the indexes.

Active investors who had exposure to Russia and maintained that exposure will undoubtedly suffer significant declines and could have substantial underperformance versus the relevant benchmarks. Some active investors who had exposure to Russia but sought to get out of that exposure may be stuck holding those positions given Russian equities’ illiquidity and “uninvestable” nature at this time. Active managers are generally working to liquidate as market conditions and regulatory limitations permit, but restrictions are likely to cause delays. These investors are also likely to experience negative impacts on performance. Some active investors had minimal to no exposure to Russia, avoiding the significant drawdowns, and could realize outperformance versus relevant indexes.

The conflict is only a little over a week old, and no one knows how it will play out. FEG will continue to engage with investment managers and other individuals to gather insights into how each responds to the situation as it develops and what to expect in the future. We will provide additional updates when relevant and necessary. Should there be other questions or concerns, please don’t hesitate to reach out to your FEG contact.

Crises are painful for investors, but they pale compared to the pain, suffering, and loss of life of those involved in the conflict. FEG hopes for a rapid and peaceful resolution to this war.

March 1, 2022

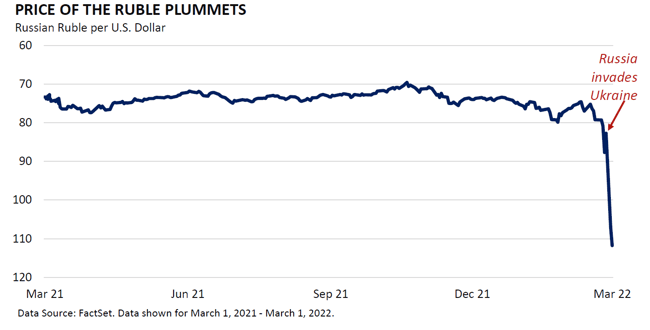

VALUE OF RUBLE PLUMMETED, EXPECT CONTINUED VOLATILITY

Since the Russian invasion of Ukraine, Western sanctions were swift and severe, triggering the value of the Russian ruble to plummet. As we said last week, we expect global market volatility to continue until a more peaceful path forward comes into focus.

Until then, investors should expect this period of heightened geopolitical concerns to be an additional factor that pressures markets in addition to inflationary pressures and the beginning of a Federal Reserve tightening cycle. We caution investors that now is not the time for making any outsized market bets. Instead, this is a time for balance and diversification.

Original FEG Memo Sent on February 23, 2022

Russia officially recognized two Ukrainian breakaway regions this week and sent “peacekeeping” troops to support and protect rebel efforts while simultaneously launching cyberattacks against Ukrainian institutions. Russia's actions have led to Western sanctions as the world watches with bated breath for Russia’s next move and the West’s response. With 2022 already a tough market, the S&P 500 hit correction levels yesterday, reaching a 10% decline from its January highs.

The conflict is still developing, and the information is murky to date. We can provide some facts to help investors better evaluate the situation. First, since the 2014 Crimean invasion, Russia has already been economically isolated by Western powers. Even though it is the largest country by landmass and is rich in minerals and resources, its GDP is smaller than Italy’s and less than 2% of global GDP, according to The World Bank.

According to FactSet, the combined Russian and Ukrainian revenue exposure of S&P 500 companies is only about 1% of total revenue. Similarly, Russia comprises only slightly more than 3% of the MSCI Emerging Market Index market capitalization. Some multinational companies have exposure to Russia and Ukraine, but these energy, commodity, and financial institutions’ risk is only part of their more considerable globally diversified exposure. Economically, the cost of energy is likely to be the primary transmission mechanism by which Russia’s actions impact most in the Western world. Europe is heavily dependent on Russian gas and oil. Specifically, Germany obtains almost a third of its crude oil and over 50% of its natural gas from Russia. Since energy is a global market priced in U.S. Dollars, Europe will not be the only region to weather the impact. One saving grace is that a large portion of natural gas is used to heat homes, and the end of the winter heating season is quickly approaching.

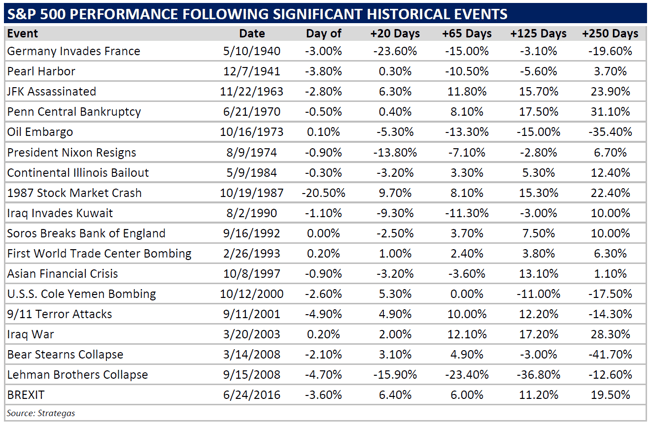

FEG, nor anyone else, knows precisely what will happen next. We can only look at history as a guide. Below is a chart from Strategas that highlights the market impacts of other historical conflicts. Most times, the conflict passes, and markets return to normal. We believe that is likely the outcome of this conflict, and strictly speaking, the economic fall-out should be limited to energy prices. The more significant cause for concern, although still a very small probability, is an expanded military conflict among superpowers. That risk should keep markets volatile until market participants view that risk as abating.

As we mentioned during our recent FEG webinar, we are in a period of heightened geopolitical concerns, high market valuations, increasing inflation, and the beginning of a Federal Reserve tightening cycle. We believe now is not the time for making any outsized market bets. Instead, this is a time for balance and diversification.

DISCLOSURES

This report was prepared by FEG (also known as Fund Evaluation Group, LLC), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directly to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202, Attention: Compliance Department.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it. FEG, its affiliates, directors, officers, employees, employee benefit programs and client accounts may have a long position in any securities of issuers discussed in this report.

Index performance results do not represent any managed portfolio returns. An investor cannot invest directly in a presented index, as an investment vehicle replicating an index would be required. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.

Neither the information nor any opinion expressed in this report constitutes an offer, or an invitation to make an offer, to buy or sell any securities.

Any return expectations provided are not intended as, and must not be regarded as, a representation, warranty or predication that the investment will achieve any particular rate of return over any particular time period or that investors will not incur losses.

Diversification or Asset Allocation does not assure or guarantee better performance and cannot eliminate the risk of investment loss.

Past performance is not indicative of future results.

This newsletter is prepared for informational purposes only. It does not address specific investment objectives, or the financial situation and the particular needs of any person who may receive this report.