FEG monitors the current market volatility within the global economy. For more insights into the Fed’s tightening cycle of rate hikes and quantitative tightening, please read our latest Research Review.

If you have any specific questions, please reach out to your FEG contact, or contact us here.

May 16, 2022

This year has seen a return to market volatility. Although it has not been the favorable market environment investors hoped for, it might be the challenging environment many expected. Both equity and bond markets have declined amid rapidly rising interest rates around the globe. Volatility has made daily equity market moves of more than a full percentage point, the norm for 2022, and apart from the COVID-19 pandemic, the CBOE Volatility Index (VIX) has not been this high since 2012. Looking back to the start of the year, despite inflation being top of mind for many, the markets were priced for a post-pandemic recovery. Instead, this year has brought monetary policy regime change driven by inflation, which gets to the heart of the recent volatility.

The Federal Reserve (Fed) has embarked on a new tightening cycle to combat persistent inflation. Supply chains have not yet recovered from the pressure of the pandemic, and recent COVID-19 lockdowns in China have only worsened conditions in some industries. The tragic war in Ukraine has increased geopolitical tensions and further added to inflation, most notably in food and energy.

Fed Chair Jerome Powell commented that there is little the Fed can do to lessen supply shocks, as the Fed’s tools are intended to impact demand. The market’s concern is that inflation becomes “stickier” or stubbornly high. The tight labor market has driven wages materially higher in some sectors. If job openings remain hard to fill, further increases in wages present the risk of a wage/price spiral.

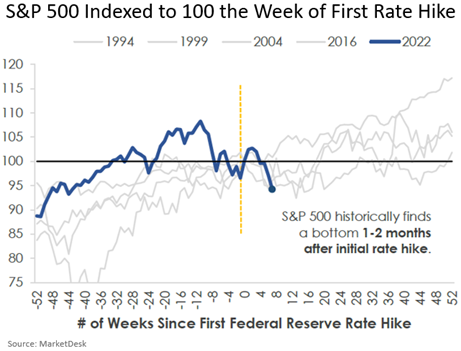

Rising input and labor costs pressure companies’ margins, and there are already signs of margin compression and weakened earnings guidance. Nevertheless, the market reaction to the start of this tightening cycle is in line with those of the past 30 years, but the market’s peak before the first hike was higher before tightening than in other instances.

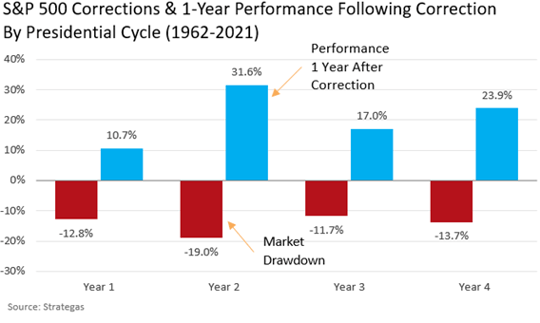

To compound matters, this is a mid-term election year, and with that comes increased uncertainty. Typically, the party that controls the White House loses seats in Congress, pressuring the markets to understand the implications of power shifts on law and policy. Sizeable drawdowns during mid-term elections are not uncommon, but 2022’s market decline has been notably rapid and substantial.

When the market declined from similarly high valuations in 2000, the return to more historically normal valuations took the better part of a year and was furthered by the onset of the 2001 recession. That is not to say that markets will do the same in 2022. Still, investors should be prepared for more than a few months of choppy markets. The global economy is still recovering from the pandemic, and inflation is a persistent concern across the globe. The key to successfully moving through such periods is, as always, to focus on the long term, avoid rash decisions, and trust that a diversified portfolio built in less stressful periods will win out over time.

DISCLOSURES

This report was prepared by FEG (also known as Fund Evaluation Group, LLC), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directly to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202, Attention: Compliance Department.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it. FEG, its affiliates, directors, officers, employees, employee benefit programs and client accounts may have a long position in any securities of issuers discussed in this report.

Index performance results do not represent any managed portfolio returns. An investor cannot invest directly in a presented index, as an investment vehicle replicating an index would be required. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.

Neither the information nor any opinion expressed in this report constitutes an offer, or an invitation to make an offer, to buy or sell any securities.

Any return expectations provided are not intended as, and must not be regarded as, a representation, warranty or predication that the investment will achieve any particular rate of return over any particular time period or that investors will not incur losses.

Diversification or Asset Allocation does not assure or guarantee better performance and cannot eliminate the risk of investment loss.

Past performance is not indicative of future results.

This newsletter is prepared for informational purposes only. It does not address specific investment objectives, or the financial situation and the particular needs of any person who may receive this report.