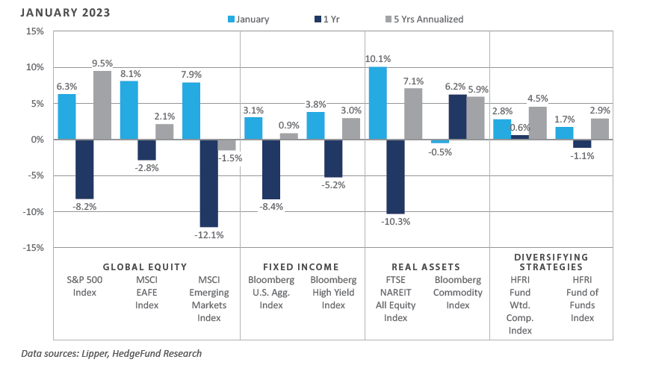

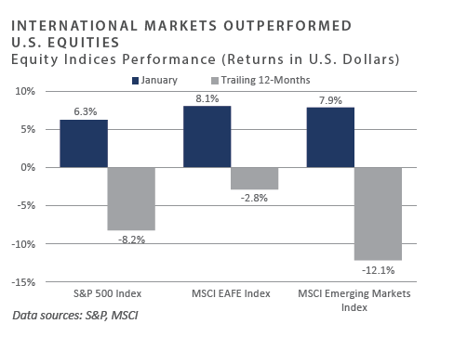

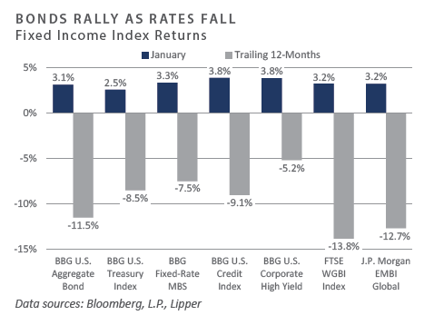

The positive performance momentum that developed across many global asset classes and categories in the fourth quarter of 2022 carried over into the first month of 2023, with investors embracing the potential for a Federal Reserve (Fed) soft landing amid cooling inflation, an economic rebound in the second half of 2022, and an ongoing robust labor market. Contrary to the experience in 2022, rate-sensitive sectors generated strongly positive returns in January, as interest rates moved meaningfully lower and expectations for a near-term pause in Fed tightening came into focus. Global equity performance was broadly positive on the month, with solid gains witnessed among international markets due to receding fears of a worldwide economic slowdown and a further rise in the U.S. dollar (USD). Similar to global equities, bond market returns were strongly positive in January; rate and credit-sensitive sectors both saw solid gains in the face of moderating interest rate volatility. Performance across the real assets landscape appeared similarly positive, with the long-duration, rate-sensitive real estate investment trust (REIT) sector enjoying the most substantial gains following 2022’s outsized decline.

Economic Update

Late 2022 Financial Market Rebound Persists through First Month of 2023

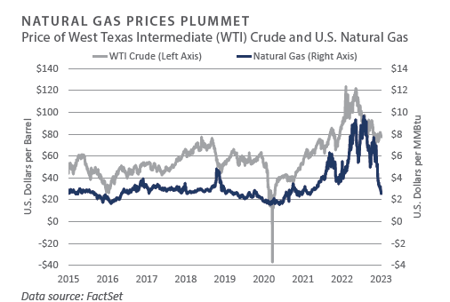

Since September 2022, incoming inflation data has appeared on a disinflationary trajectory—albeit from a multi- decade high base formed over the first three quarters of the year—with market participants seemingly interpreting the reversal in inflationary momentum as a signal that the Fed’s tightening campaign may be nearing an end. Several factors support this thesis, such as a recent reversal in positive momentum across commodity prices, particularly energy—e.g., crude oil and natural gas—moderating employee wage growth, deterioration among leading economic indicators, and a resilient and historically tight labor market.

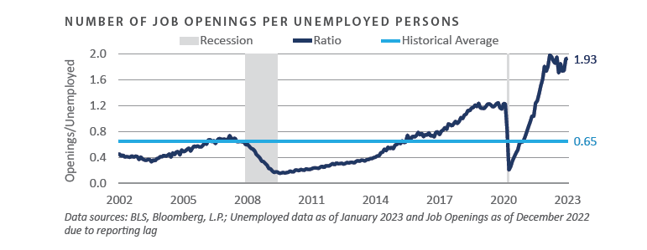

Underscoring the extremely tight labor situation in the U.S. was January’s headline unemployment rate, which was the lowest reported rate since 1969, at 3.4%. The first month of 2023 also registered the strongest payrolls figure in six months, with 517,000 jobs added. Moreover, the ratio of the number of job openings to the number of unemployed stood at a historically wide level through the month, with the openings exceeding the number of unemployed individuals by a nearly two-to-one ratio at 11 million to 5.7 million, respectively.

The resilience of the U.S. labor market comes at a time when the Fed has tightened monetary conditions at the most aggressive clip since the 1970s and early 1980s. This includes an additional 25 basis point increase to the policy rate announced at the January 31 - February 1 meeting, which brought the targeted upper bound on the federal funds rate to 4.75%, a level 450 basis points higher than the year prior. Moreover, the Fed’s quantitative tightening measures have led to a decline of more than $500 billion in the size of their balance sheet, which peaked at $8.97 trillion in April 2022 and has since dropped to $8.43 trillion. Related declines across commercial bank reserve liquidity have taken hold since 2021, with reserve balances of U.S. commercial banks plunging by more than $1 trillion from December 2021 through January 2023.

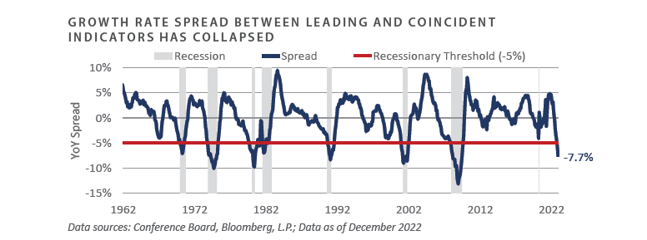

The dynamics which have supported the impressive rally across stocks, bonds, and real assets over the past four months have seemingly diverged from the deterioration among forward measures of the trajectory of near-term economic growth. This phenomenon has gathered pace in recent months. The spread between the annual growth rate of the Conference Board’s leading and coincident economic indicator data sets has rapidly collapsed into recessionary territory.

To conclude, strong performance tailwinds formed in the final quarter of 2022 across many corners of the global investment universe have carried over into 2023, with expectations of a break in the Fed’s tightening efforts coming into the near-term view. This incremental change in policy stance is seemingly supported by cooling inflation, slumping commodity prices, and deterioration among some widely-tracked cyclical gauges. As the window for a Fed-engineered soft landing appears to have opened slightly in recent months, some cyclical measures of the near-term implied path of the U.S. economy have soured, creating a sizable disparity between current economic conditions and those which might ultimately materialize in the coming quarters.

Market Summary

Global Equity

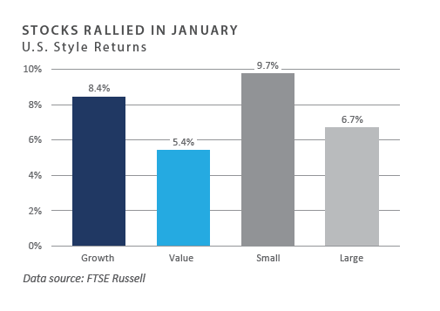

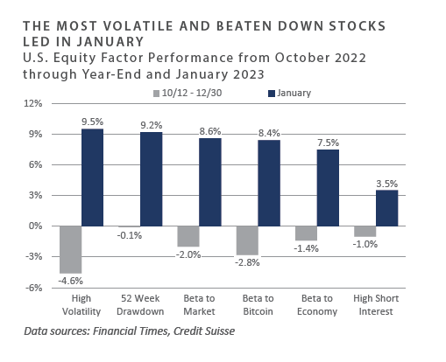

- Global stock markets started the year with positive returns for January. After inflation cooled for the sixth consecutive month in December, the information technology and consumer discretionary sectors saw substantial gains. The significant reversal in sentiment led to many unprofitable and meme stocks rallying, with names like AMC, GameStop, and the ARK Innovation ETF all climbing more than 18% to start 2023. Most jarring was the eCommerce company Carvana, which finished January with a gain of approximately 115%.

- Large cap stock earnings reports were mixed during the month. Approximately 70% of S&P 500 companies reported above-estimated earnings but lowered their forward guidance, citing less visibility and possible margin compression. Earnings in the communication services sector were hit the hardest, with only 45% of companies reporting above or in line with earnings estimates. Although traditionally defensive sectors like utilities, consumer staples, and health care reported robust earnings relative to other sectors, they ended the month with negative returns.

- European equities outperformed most other regions in January as slowing inflation data from the region led to improved sentiment from investors. The declining U.S. dollar also helped improve international and emerging market returns after serving as a headwind over the last year. The best-performing sectors were information technology and consumer discretionary, with luxury goods exhibiting strong performance on the news of China’s economic reopening. U.K. equities also started the year with positive returns. The easing of energy prices in the area and improving macroeconomic data out of the United Kingdom supported less defensive stocks.

- Although Japanese equity returns were positive for the month, the country underperformed most other regions. The yen initially strengthened against the U.S. dollar in January but gave back some gains in the month's second half. The acceleration of inflation in Japan has led to a 4.0% year-over-year inflation rate, the highest reading for the country in 31 years, and double the Bank of Japan's target rate.

- Emerging market equities posted positive returns over the month of January. China’s shift from a zero-COVID policy towards reopening improved the country’s macroeconomic backdrop. Following this change, the MSCI China Index rallied strongly, increasing the total return since October’s low to 52.3%. China’s reopening has also benefitted neighboring countries like Taiwan and Korea, whose information technology sectors returned 13.3% and 11.4%, respectively, in the first month of 2023. Taiwan Semiconductor provided mixed fourth-quarter earnings—the company beat earnings expectations but missed revenue expectations, rallying approximately 25.3% to start the year. Another bright spot in emerging markets was Latin America, as Mexico returned 17.0%, with the materials, financials, and industrials sectors being the largest contributors to performance.

Fixed Income

- Interest rate sensitive sectors rallied to start 2023 as interest rates broadly fell across the curve. The 2-year Treasury yield fell 0.2% to 4.2%, while the 10-year Treasury yield fell 0.4% to 3.5%. January’s bull flattener movement sent the 10-year/2-year Treasury spread to -0.7% from -0.5%, marking the seventh consecutive month of inversion. The disparity between market expectations and Fed Chair Powell’s forward guidance persists, with Fed fund futures at the end of January continuing to show an expected peak terminal rate below 5% with roughly 0.5% of rate cuts in 2023 despite guidance that there is “more work to do.”

- Economic data points continue to show opposing momentum between expansion and contraction. January’s ISM Manufacturing report—released in February—printed below sell-side estimates at 47.4, its third successive month below the critical 50 expansion/contraction level. Conversely, January’s non-farm payroll report outstripped expectations, showing 517,000 jobs created and pushing the unemployment rate to a multi-decade low of 3.4%. January’s employment report will likely give the Fed more ammunition to keep monetary policy in restrictive territory, given their belief that an extremely tight labor market could put upward pressure on wages.

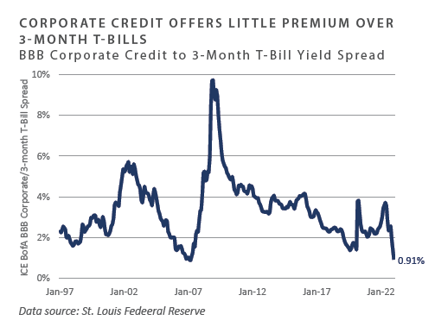

- Credit spreads rallied with investment grade (IG) and high yield (HY) option-adjusted spreads (OAS) falling 13 bps and 51 bps, respectively. Spread sectors benefitted from positive technical as allocators increased exposure to riskier segments of the fixed income market. HY mutual funds saw roughly $71 billion of outflow in 2022; however, those trends appear to have reversed in 2023, as credit funds received billions in inflows in January alone.

- Agency mortgages outperformed duration- matched Treasuries on the back of abating interest rate volatility and compressing spreads. The U.S. housing market spurred back to life during the month when mortgage rates began to decline from their highs. Notably, 30-year fixed-rate mortgages ended the month near 6.1%, roughly 0.9% lower than levels seen in November. The relative decline in mortgage rates sparked a flurry of mortgage applications as buyers re-entered the market. Despite the uptick in mortgage applications in January, refinancing activity was down over 92% year-over-year.

Real Assets

REAL ESTATE

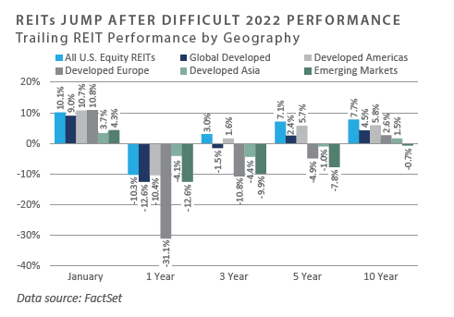

- All global real estate investment trust (REIT) indices had positive returns during the first month of 2023. The U.S. and developed European indices outperformed developed Asia and emerging markets. The lagging performance in Asia is attributed to Japanese REITs, which suffered due to a strong yen and increased expectations that the Bank of Japan will reverse its loose monetary policy.

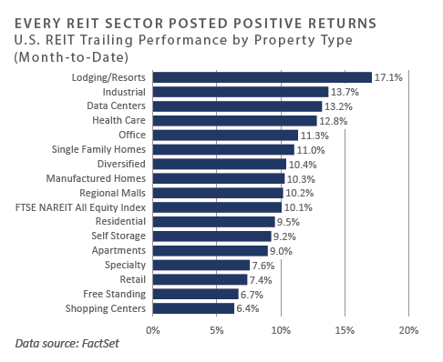

- All U.S. REIT subsector index returns were positive during January, a complete reversal from December 2022. Lodging and resorts led sector performance during the month despite recession fears and recent travel disruptions, buoyed by steady post- pandemic operational improvements fueling dividend resumptions. Travel demand softened in the last few months of 2022, but preliminary data in January shows surprisingly strong momentum in early 2023.

NATURAL RESOURCES

- WTI Crude Oil declined 1.7% in January— the third consecutive monthly loss—despite data from China showing the country’s crude oil demand is rebounding. Travel in China surged after the Lunar New Year, resulting in increased jet fuel and gasoline consumption. Natural gas (continuous contract) declined, falling 34.6% in January. Weather forecasts in the U.S. and Europe called for milder-than-expected winter weather, with recent forecasts predicting a continuation of warmer weather into the first few weeks of February.

- Both industrial and precious metal returns were positive during January. Zinc, copper, and aluminum outperformed broader commodities as the market expected China’s economic recovery to aid industrial demand.

INFRASTRUCTURE

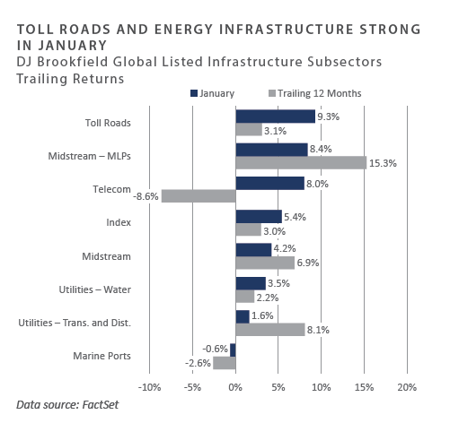

- The broad midstream energy infrastructure sector posted strong returns during January, with master limited partnerships (MLPs) outperforming C corporations (C-corps). Strong performance has continued despite recent oil and natural gas price slides, driven by improved MLP fundamentals through company share buyback programs, paying down debt, and returning free cash flow to shareholders.

- Toll roads led global listed infrastructure sector performance, posting a 9.3% return during January. According to Fitch Ratings, China’s reopening and increased travel helped lift the sector’s performance as overall traffic from China is expected to rebound and improve operators’ profitability in 2023. Data released by China’s Ministry of Transport showed the total number of passengers across all passenger transport sectors during January 7-16, 2023, increased 46.2% compared to the same period in 2022. This number was 52.2% short of the amount during the same period in 2019, however.

Diversifying Strategies

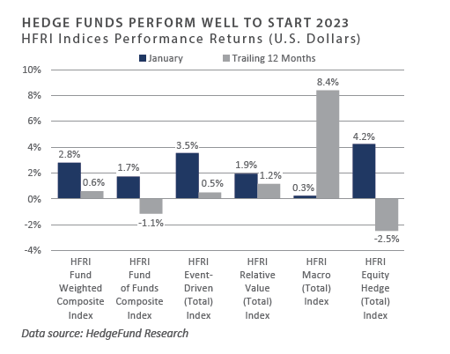

- Hedge funds generated strong gains in January, led by equity hedge and event- driven strategies. Within equity hedge, energy and basic materials were the leading sectors, while activism provided outsized returns in the event-driven space.

- Trend-following managers faced minor headwinds in January after robust gains throughout most of 2022. The majority of losses during the month were in fixed income and developed currencies. Gains in equities and metals slightly offset the performance drag.

- Multi-strategy managers started the year off with positive performance. There is an overall trend in the hedge fund industry of increasing allocations to multi-strategy/ multi-manager platforms.

- Discretionary macro managers continue to see attractive opportunities as central banks globally have diverged in policy management. Asia is providing particularly attractive investments within Japanese rates and the general re-opening of China.

INDICES

The Alerian MLP Index is a composite of the 50 most prominent energy Master Limited Partnerships that provides investors with an unbiased, comprehensive benchmark for this emerging asset class.

Bloomberg Fixed Income Indices is an index family comprised of the Bloomberg US Aggregate Index, Government/Corporate Bond Index, Mortgage-Backed Securities Index, and Asset-Backed Securities Index, Municipal Index, High-Yield Index, Commodity Index and others designed to represent the broad fixed income markets and sectors. On August 24, 2016, Bloomberg acquired these long-standing assets from Barclays Bank PLC. and on August 24, 2021, they were rebranded as the Bloomberg Fixed Income Indices. See https://www.bloomberg.com/markets/rates-bonds/bloomberg-fixed-income-indices for more information..

The CBOE Volatility Index (VIX) is an up-to-the-minute market estimate of expected volatility that is calculated by using real-time S&P 500 Index option bid/ask quotes. The Index uses nearby and second nearby options with at least eight days left to expiration and then weights them to yield a constant, 30-day measure of the expected volatility of the S&P 500 Index.

FTSE Real Estate Indices (NAREIT Index and EPRA/NAREIT Index) includes only those companies that meet minimum size, liquidity and free float criteria as set forth by FTSE and is meant as a broad representation of publicly traded real estate securities. Relevant real estate activities are defined as the ownership, disposure, and development of income-producing real estate. See https://www.ftserussell.com/index/category/real-estate for more information.

HFRI Monthly Indices (HFRI) are equally weighted performance indexes, compiled by Hedge Fund Research Inc. (HFX), and are used by numerous hedge fund managers as a benchmark for their own hedge funds. The HFRI are broken down into 37 different categories by strategy, including the HFRI Fund Weighted Composite, which accounts for over 2,000 funds listed on the internal HFR Database. The HFRI Fund of Funds Composite Index is an equal weighted, net of fee, index composed of approximately 800 fund- of- funds which report to HFR. See www.hedgefundresearch.com for more information on index construction.

J.P. Morgan’s Global Index Research group produces proprietary index products that track emerging markets, government debt, and corporate debt asset classes. Some of these indices include the JPMorgan Emerging Market Bond Plus Index, JPMorgan Emerging Market Local Plus Index, JPMorgan Global Bond Non-U.S. Index and JPMorgan Global Bond Non-U.S. Index. See www.jpmorgan.com for more information.

Merrill Lynch high yield indices measure the performance of securities that pay interest in cash and have a credit rating of below investment grade. Merrill Lynch uses a composite of Fitch Ratings, Moody’s and Standard and Poor’s credit ratings in selecting bonds for these indices. These ratings measure the risk that the bond issuer will fail to pay interest or to repay principal in full. See www.ml.com for more information.

Morgan Stanley Capital International – MSCI is a series of indices constructed by Morgan Stanley to help institutional investors benchmark their returns. There are a wide range of indices created by Morgan Stanley covering a multitude of developed and emerging economies and economic sectors. See www.morganstanley.com for more information.

The FTSE Nareit All Equity REITs Index is a free-float adjusted, market capitalization-weighted index of U.S. equity REITs.

Russell Investments rank U.S. common stocks from largest to smallest market capitalization at each annual reconstitution period (May 31). The primary Russell Indices are defined as follows: 1) the top 3,000 stocks become the Russell 3000 Index, 2) the largest 1,000 stocks become the Russell 1000 Index, 3) the smallest 800 stocks in the Russell 1000 Index become the Russell Midcap index, 4) the next 2,000 stocks become the Russell 2000 Index, 5) the smallest 1,000 in the Russell 2000 Index plus the next smallest 1,000 comprise the Russell Microcap Index, and 6) U.S. Equity REITs comprise the FTSE Nareit All Equity REIT Index. See www.russell.com for more information.

S&P 500 Index consists of 500 stocks chosen for market size, liquidity and industry group representation, among other factors by the S&P Index Committee, which is a team of analysts and economists at Standard and Poor’s. The S&P 500 is a market-value weighted index, which means each stock’s weight in the index is proportionate to its market value and is designed to be a leading indicator of U.S. equities, and meant to reflect the risk/return characteristics of the large cap universe. See www.standardandpoors.com for more information.

Information on any indices mentioned can be obtained either through your advisor or by written request to information@feg.com.

DISCLOSURES

This report was prepared by FEG (also known as Fund Evaluation Group, LLC), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directly to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202, Attention: Compliance Department.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it. FEG, its affiliates, directors, officers, employees, employee benefit programs and client accounts may have a long position in any securities of issuers discussed in this report.

Index performance results do not represent any managed portfolio returns. An investor cannot invest directly in a presented index, as an investment vehicle replicating an index would be required. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith.

Neither the information nor any opinion expressed in this report constitutes an offer, or an invitation to make an offer, to buy or sell any securities.

Any return expectations provided are not intended as, and must not be regarded as, a representation, warranty or predication that the investment will achieve any particular rate of return over any particular time period or that investors will not incur losses.

Past performance is not indicative of future results.

Investments in private funds are speculative, involve a high degree of risk, and are designed for sophisticated investors.

All data is as of January 31, 2023 unless otherwise noted.