FEG will continue to provide updates on this evolving situation. Please reach out to your FEG contact with any questions.

October 2, 2023

House Speaker Kevin McCarthy reversed his position on a bipartisan deal, and Congress temporarily averted a government shutdown by voting to fund federal operations through mid-November. Although the legislation includes disaster aid, it leaves key issues unresolved, including aid to Ukraine, border security, and government spending levels. As we mentioned in our communication last week, markets generally bear minimal impact from a government shutdown. Nevertheless, the federal debt service cost is increasing for the first time in 35 years and presents a new challenge for Congress. Positively, with the passing of the funding legislation, the Fed will have access to important inflation and employment data ahead of its forthcoming fall meeting, when an additional rate hike is expected for a market and economy adjusting to higher interest rates.

September 28, 2023

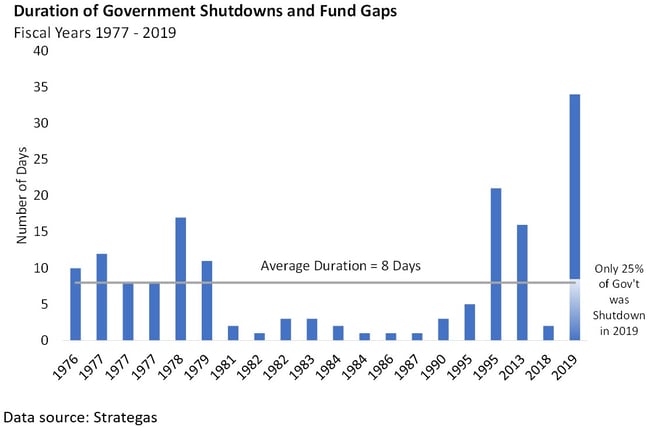

The risk of a government shutdown on October 1 presents one more item to a growing list of concerns for investors. Despite the media attention and political grandstanding, investors should gain comfort in knowing that government shutdowns have historically been short-lived and had little in the way of long-term impact on the equity markets or economic growth. Nevertheless, budgetary fights and any shutdown may weigh on short-term market sentiment as issues are debated, and Moody’s rating agency could also put U.S. government debt on credit watch.

On Monday, Moody’s, the sole rating agency holding U.S. sovereign debt at AAA-rated status, released a candid report citing governance concerns regarding the potential shutdown. While the report came short of a downgrade, the stern language underscored that continued governance weakness consisting of a process of repeated shutdowns and short-term extensions could be the catalyst for a downgrade.

June’s debt ceiling resolution was intended to push current concerns into 2025, but as some representatives have expressed apprehension over the details, they are refusing to vote for funding levels to codify the agreement. Issues of contention include immigration policy, funding for Ukraine, and a deteriorating fiscal condition. In this instance, market expectations of default risk remain limited. Credit default swap spreads on U.S. Treasuries have risen in recent weeks but remain well below levels that preceded this summer’s debt ceiling debate.

In the event of a government shutdown, federal workers would temporarily stop working, but they would receive backpay once funding is resumed. Of lesser consequence but relevant for investors, economic data would not be released amid the current market volatility as investors watch the impacts of declining excess savings, the United Auto Workers strike, and the impact of the resumption of student loan payments weighing on consumer spending.

This debate has been occurring as the Federal Reserve’s message to the markets was higher for longer following its recent decision to hold rates steady. The potential for the Fed to maintain higher rates for longer than the consensus previously anticipated is of greater consequence to markets, as higher interest rates foreshadow increasing debt service costs, which are beginning to have impacts on borrowers.

Regardless of the political statements, investors should remember that the fundamental drivers of markets remain in place with or without a temporary government shutdown, as there are a multitude of other more influential items impacting markets.

DISCLOSURES

This information was prepared by FEG (also known as Fund Evaluation Group, LLC), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directly to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202, Attention: Compliance Department.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it.