In life, there are a handful of universal truths: the sun rises in the east and sets in the west, the only person you can control is yourself, and there is no cure for the common cold. The symptoms and treatment of the cold are described in the world’s oldest medical text, the Egyptian Ebers papyrus, which dates back to the 16th century BCE. Despite the ensuing centuries of medical advances and the development of entire branches of science devoted to identifying and curing disease, no surefire remedy has ever been developed to treat the cold. Similarly, although humans have come a long way in understanding the nuanced complexities of the financial markets, no one has devised a way to predict the markets’ twists and turns with 100% accuracy. Thus, some discomfort is expected in navigating the financial markets and the common cold.

NAVIGATING HIGH-RATE ENVIRONMENTS WITH STRATEGIC HEDGE FUND ALLOCATIONS

This topic is particularly relevant after a prolonged period of historically low interest rates. While elevated rates feel like a new phenomenon, looking back in history, investors have experienced much higher rate environments. In those periods, it is common for central banks to intervene to combat inflation and/or stabilize the economic environment via interest rate policy.

Consider the historical trajectory of the federal funds rate. Initially low through the 1950s and the 1960s (1%-5%), reflecting post-WWII growth, rates surged above 13% in the 1970s due to high inflation. In the 1980s, Federal Reserve (Fed) Chairman Paul Volcker's anti-inflationary tactics drove rates to nearly 20%. Rates fell to 1% after the late 1990s but rose to over 5% leading up to the 2007-2008 financial crisis. The Fed then reduced rates to near 0% to combat the crisis and maintained this level until 2015. Rates gradually increased to 2.25%-2.50% by the end of 2018; however, due to economic uncertainties and the COVID-19 pandemic, rates were cut back to nearly 0% again in 2020 to bolster the economy.

The current interest rate environment is a pivotal factor influencing investment decisions and asset prices and is at the heart of today’s market complexities. Understandably, investors are left with many questions about the role and suitability of hedge fund allocations in such an environment.

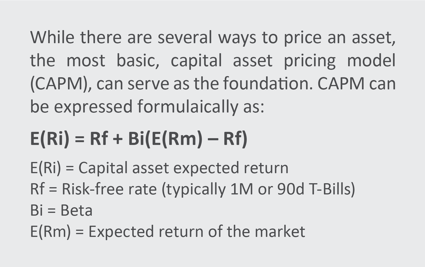

As short-term rates change, it is important to revisit the building blocks of asset pricing, a critical component of investment analysis. Interest rates are an input in determining the value of various asset classes. Generally, as the risk-free rate increases, so does the expected return across asset classes; however, this does not account for shortterm mark-to-market impacts. In the newly elevated rate environment, for example, currently owned traditional fixed income investments—typically seen as safe havens— have faced challenges due to the inverse relationship between rates and bond prices, evidenced by the Bloomberg U.S. Aggregate Bond Index declining 13.5% from March 2022 to October 2022.

Increased interest rate volatility has led investors to consider the need for alternative sources of return and improved diversification. This context brings hedge funds to the forefront as a potential complement to fixed income portfolios. With their broad mandate for investment strategies, including long-short equity, global macro, event-driven, and relative value, hedge funds offer flexibility and potential for alpha generation less dependent on interest rate moves.

There is ample rationale supporting hedge fund allocation in a diversified investment portfolio, particularly in a scenario where traditional bonds may no longer suffice to meet the risk-return objectives of investors. FEG will examine the advantages and risks associated with hedge funds, their performance in rising interest rate environments, and how they can be integrated into an investment portfolio to enhance returns, reduce volatility, and improve overall portfolio diversification.

Given the current rate environment, hedge funds and fixed income allocations are attracting increased attention from institutional investors. While conversations persist about the market’s fundamental drivers in the future—earnings, Fed policy, inflation, valuations, and sentiment—those discussions have evolved to determine the role of hedge funds and fixed income in a broader client portfolio with elevated fixed income yields. In practice, investors should not take lightly the need to clearly define the role of hedge fund and fixed income portfolios due to various factors that may skew underlying risk and expected return.

HEDGE FUNDS - ROLE/CHARACTERISTICS

Allocators utilize asset classes with different goals and expectations. Recently, FEG asked members of a foundation’s investment committee to describe the purpose of the organization’s hedge fund and fixed income allocations. The responses were numerous and sometimes divergent: lower volatility, correlation benefits to other asset classes, higher return expectation, downside protection, absolute return, risk parity, tactical, currency hedges, and income generation. The wide range of responses illustrates that interpretations and objectives may differ substantially.

On a stand-alone basis, such wide-ranging objectives often lead to elevated strategy turnover inside the portfolio. Investor problems most often arise when investment committees or staff are not aligned on the role of a particular asset class. As a baseline, investors should be clear about the objectives, time horizon, and liquidity needs for hedge fund and fixed income allocations.

Hedge fund and fixed income portfolios offer distinct benefits to a client portfolio. Hedge funds can act as a risk mitigator or unique alpha source. Conversely, fixed income can serve as a hedge against deflation, a predictable income stream, and a counterbalance to equity volatility. Common reasons to reallocate capital between hedge funds and fixed income include liquidity requirement shifts, time horizon changes, or risk tolerance budgeting.

As rates increase, investors often get lured into increasing their fixed income allocation hoping for a higher return. Relying on hindsight, picking an attractive entry point for investors with a marginal dollar seems possible. Unfortunately, investors do not have the luxury of hindsight when looking to achieve an optimal entry point. Accurately predicting interest rate changes and other influential market factors is a difficult exercise, and consistently translating forecasts into informed decisions is quite a challenge.

In theory, tactical changes appear to have valid academic support, but they can lead to suboptimal outcomes in practice. This is because there are many factors investors must predict, including the appropriate timing of their investment and the direction of markets, and even slightly inaccurate predictions can result in significant frictional costs.

Predicting the direction and magnitude of changes in capital markets is an incredibly challenging undertaking. Even if investors had a crystal ball to predict rate moves, implementing a strategy of timing fixed income and hedge fund allocations is fraught with structural challenges. Many hedge funds employ lock-up periods and gating provisions, creating a semi-liquid portfolio allocation, which limits the efficacy of utilizing hedge funds as a source of liquidity.

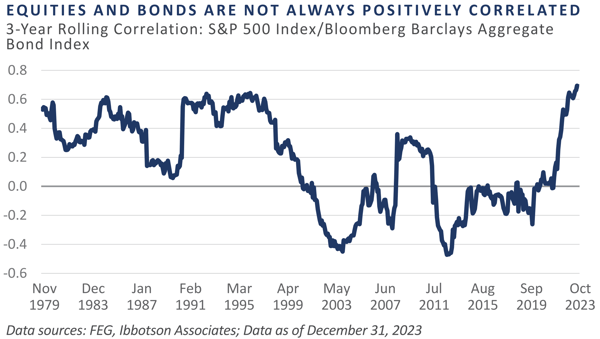

Further, a common misconception is that equities and fixed income are always negatively correlated, exposing investors to a false sense of diversification. History shows that equities and fixed income have been positively correlated for prolonged periods. Hedge funds can provide a ballast to offer diversification benefits when fixed income correlates to broader equity markets.

It is impossible to predict which asset class, let alone a specific strategy, will outperform over a given month, quarter, or year. Strategically diversifying portfolios by investing across many asset classes and strategies with unique underlying risk factors increases the likelihood of meeting their stated objectives and goals in the long run.

Given the number of unknowns, creating a diversified, strategic allocation to mitigate specific asset class risks is prudent. Investing in multiple asset classes can increase the probability of a more favorable outcome throughout various market environments and interest rate regimes.

EFFECTS OF INTEREST RATES ON ASSET CLASSES

Numerous factors can impact asset class returns, including inflation, interest rate policy, economic health, geopolitical events, and market sentiment. Typically viewed as safe-haven, low-volatility assets, fixed income can undergo large drawdowns in certain circumstances. Those drawdowns can also coincide with periods when equities are also going through a dislocation period. An extreme example in the U.S. bond market was in 1981 when the U.S. experienced historically high inflation, so the Fed implemented a policy that aggressively raised interest rates. In June of that year, the federal funds rate peaked at around 20%.

This shift in monetary policy had significant implications for both fixed income and equities. From July 1980 to October 1980, long-term Treasuries sold off over 14% during a hiking cycle that saw the federal funds rate increase by roughly 4%.

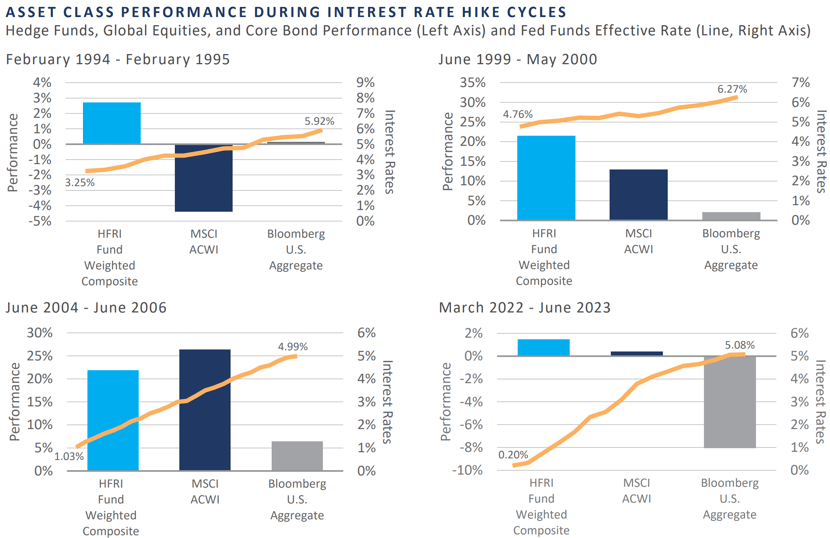

Hedge funds offer flexibility in navigating rising interest rate environments, enabling portfolios to generate positive returns despite directional market movements. FEG has evaluated pivotal moments throughout history in which the rate environment shifted drastically. Throughout all periods studied since 1990, hedge funds were the only asset class with positive returns, averaging 12% compared to equities (9.0%) and fixed income (0.0%) over those four rising rate cycles.

THE CASE FOR HEDGE FUNDS TODAY

Introducing cold medicines to help ease the brunt of the common cold is a prime example of human ingenuity. Similarly, introducing new asset classes in the late 1980s/early 1990s changed how investors engaged with the markets. In the late 1980s/early 1990s, the utilization of new asset classes was popularized by university endowments to reduce the concentration of equity and fixed income risk in their portfolios.

Absolute return hedge funds seek to generate idiosyncratic returns—i.e., alpha—throughout market cycles. By definition, alpha is uncorrelated to traditional asset class returns and thus helps create a more optimal portfolio. The lessening of reliance on equity beta minimizes the drawdown in adverse markets due to the diversifying properties of hedge funds.

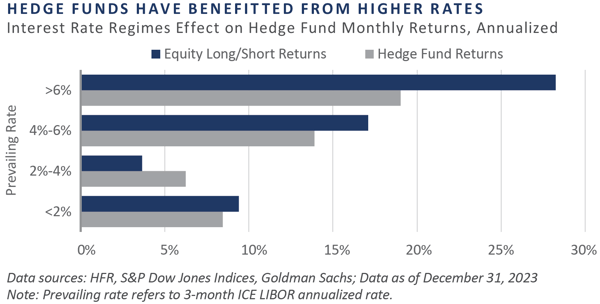

Hedge funds can be uniquely positioned to extract alpha, especially in periods of interest rate volatility. Hedge funds have a broad mandate through a specialized structure, allowing them to invest across asset classes in varying styles, including long and short. While generating returns absent market beta, hedge funds can be additive to return potential without taking an incremental increase in portfolio volatility. As interest rates increase, ancillary impacts cause tailwinds for hedge funds, such as a higher rate on collateral and money market funds.

The benefits stem from the opportunities that arise in higher-rate environments and the increased potential for earning returns on cash and cash-equivalent positions. For example, for the first time since 2008, the short rebate received by long/short equity managers exceeded the equity dividend yield. Another benefit is that hedge funds that utilize derivatives, such as global macro, have greater leverage efficiency. If hedge funds can borrow at rates lower than the returns they generate from their investments (CAPM), the spread between borrowing costs and investment returns can be more favorable if the fund’s investments are in assets that appreciate or yield more as rates rise. Lastly, enhanced returns can stem from rate-sensitive strategies. Some hedge fund strategies benefit from market volatility and price dislocations related to expected and actual interest rate movements.

CONCLUSION

Choosing the right remedy for the common cold is not a “one-size-fits-all” situation—variables such as age, demographics, underlying health conditions, and activity level should all be considered. Similarly, there is no “one-size-fits-all” approach for investors looking to take advantage of a changing rate environment.

As with any significant changes, associated risks and opportunities will emerge, but unfortunately for investors, there is no evidence to suggest that investing in new fixed income allocations, given higher interest rate levels, will be immune from performance challenges. FEG believes investors should be wary of recency bias as rates can always move higher or remain steady. This, coupled with the fact that hedge funds generally perform favorably in higher-rate environments, suggests investors should maintain a strategic, diversified allocation.

Fiduciaries are best served to maintain diversified allocation targets across a dichotomy of asset classes and return streams. For investors where alternative investments are appropriate, those unique return streams are best served with exposure to diversified hedge funds and fixed income allocations.

DISCLOSURES

This report was prepared by Fund Evaluation Group, LLC (FEG), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it.

Neither the information nor any opinion expressed in this report constitutes an offer, or an invitation to make an offer, to buy or sell any securities.

Any return expectations provided are not intended as, and must not be regarded as, a representation, warranty or predication that the investment will achieve any particular rate of return over any particular time period or that investors will not incur losses.

Past performance is not indicative of future results.

This report is prepared for informational purposes only. It does not address specific investment objectives, or the financial situation and the particular needs of any person who may receive this report.

Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directed to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202 Attention: Compliance Department.