Having the right governance structure is key to an organization’s success. Good governance leads to good decision-making across the entire organization, including the investment committee. Conversely, a poor governance structure can lead to underperformance across an organization. The governance framework serves as a foundation upon which an organization builds different roles and processes. Without a sturdy foundation, the overall structure is more likely to deteriorate in times of stress.

The key to creating good governance is to establish clear guidelines for decision-making, delegation, and accountability.

THE ROLE OF INVESTMENT COMMITTEES

To develop the right investment committee for your organization, it is important to first understand members’ roles and responsibilities. Investment committee members, or fiduciaries, tend to be concerned with helping an organization achieve its long-term portfolio performance goals. To do this, they need to fully understand their fiduciary responsibilities and how their role fits into the plan to put the organization’s governance best practices into action.

Creating the right governance structure can help investment committee members identify their responsibilities so they can be more effective in their positions. An ideal governance structure starts with the “governing” fiduciaries of the investment board. They serve as the first line of decision-making on broader, large impact issues, and they can assign other fiduciary duties downward to the “managing fiduciaries.”

The managing fiduciaries are usually staff or consultants that the investment committee selects to oversee the investment program and ensure it is implemented in a way that aligns with the organization’s goals. The managing fiduciaries report up to the governing fiduciaries and assign responsibilities down to the “operating fiduciaries.”

The operating fiduciaries, who are usually investment managers, custodians, or actuaries, focus more on the day-to-day responsibilities of portfolio management, such as deciding when to buy and sell securities based on daily market movement or events. These operating fiduciaries report to the managing fiduciaries. Typically, the duties of operating fiduciaries have a smaller impact on the overall organization than the actions of the governing or managing fiduciaries.

DEVELOPING THE FRAMEWORK

1.) SELECT A GOVERNANCE STRUCTURE

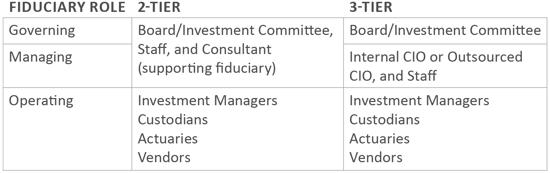

First, determine whether you want your governance structure to include all three roles—governing, managing, and operating fiduciaries—or if you would rather combine the governing and managing positions into one role.

Many organizations—especially smaller organizations that do not have a chief investment officer (CIO)—opt for a two-tiered approach in which the governing fiduciary, typically with the guidance of a consultant, retains hire/fire discretion for operating fiduciaries.

The primary benefit of the two-tiered approach is that it is often simpler to implement and can be less expensive than the three-tiered approach. It is generally more affordable to use a consultant than to create an internal CIO or outsourced CIO (OCIO) position. Drawbacks to consider include reduced fiduciary oversight as the consultant is acting as a supporting fiduciary vs. a co-fiduciary, and increased overlap between the roles and responsibilities of those in the two tiers.

With a three-tiered approach, you may consider the “governing fiduciary” to be the investment committee or board, the “managing fiduciary” to be the CIO or other executive staff (or perhaps a consultant), and the “operating fiduciaries” to be the investment managers, custodians, actuaries. In lieu of a CIO, a nonprofit may opt to outsource that position to an OCIO, who would assume the responsibility for hiring or firing investment managers.

The primary benefit of the three-tiered approach is that it offers the clearest delineation of roles and responsibilities An OCIO may provide additional fiduciary oversight because the OCIO is a co-fiduciary. The primary downside of having three tiers is that it is typically more expensive to have an internal CIO or OCIO than a consultant.

2.) SPECIFY FIDUCIARY RESPONSIBILITIES

Next, you will want to clearly define the responsibilities for all fiduciaries so they can develop the right strategies to fulfill their obligations. Here are just a few examples:

Governing Fiduciaries

- Establish organization’s long-term financial objectives

- Draft investment policy statement

- Develop guidelines to evaluate Investment Committee progress

- Develop clear risk guidelines

Managing Fiduciaries

- Hire investment managers

- Report to governing fiduciaries

- Delegate to operating fiduciaries

- Evaluate investments and/or investment managers

Operating Fiduciaries

- Adjust portfolio according to the organization’s goals and risk tolerance

- Rebalance portfolio in response to market conditions

- Report to managing fiduciaries

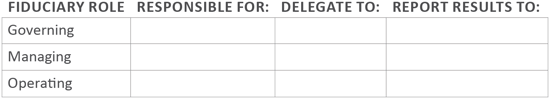

3.) DETERMINE EXPECTATIONS AND ACCOUNTABILITY

Finally, you will want to establish clear expectations for how fiduciaries will carry out their responsibilities. That includes creating clear communication channels and a policy that specifies how the different levels of fiduciaries should communicate with each other. You will also need a system for delegating responsibilities that includes reporting expectations about decision-making priorities and reporting results.

Enforcing accountability is a challenge for organizations across all industries and sizes. Adopting the following practices can encourage stakeholders to take responsibility and address issues in a direct and open manner:

- Put people who take ownership of their results into leadership roles

- Set SMART goals that are specific, measurable, achievable, relevant, and time-based

- Document roles, goals, and reporting expectations – and make it accessible to the entire organization

- Delegate authority to leaders that directly impact results

- Communicate progress updates on a regular basis

- Establish a review cadence and openly address deficiencies

We recommend the following framework to outline your own roles and responsibilities.

THE BOTTOM LINE

Creating a governance framework for your organization’s investing needs is no small task, but it is an essential one. Building a strong governance framework is one of the best ways you can support your organization’s investment goals.

An organization’s strength and health depend on everyone under the investment committee’s purview fully understanding their fiduciary duties—including those serving in a given role and those appointing others. It is critical that you structure your governance framework so that it best supports your organization’s initiatives with clearly articulated communication channels, expectations, and accountability standards.

DISCLOSURES

This report was prepared by FEG (also known as Fund Evaluation Group, LLC), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directly to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202, Attention: Compliance Department.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it. FEG, its affiliates, directors, officers, employees, employee benefit programs and client accounts may have a long position in any securities of issuers discussed in this report.

Index performance results do not represent any managed portfolio returns. An investor cannot invest directly in a presented index, as an investment vehicle replicating an index would be required. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.

Neither the information nor any opinion expressed in this report constitutes an offer, or an invitation to make an offer, to buy or sell any securities.

Any return expectations provided are not intended as, and must not be regarded as, a representation, warranty or predication that the investment will achieve any particular rate of return over any particular time period or that investors will not incur losses.

Past performance is not indicative of future results.

Investments in private funds are speculative, involve a high degree of risk, and are designed for sophisticated investors.

All data is as of May 31, 2020 unless otherwise noted.

INDICES

The Alerian MLP Index is a composite of the 50 most prominent energy Master Limited Partnerships that provides investors with an unbiased, comprehensive benchmark for this emerging asset class.

Barclays Capital Fixed Income Indices is an index family comprised of the Barclays Capital Aggregate Index, Government/Corporate Bond Index, Mortgage-Backed Securities Index, and Asset-Backed Securities Index, Municipal Index, High-Yield Index, and others designed to represent the broad fixed income markets and sectors within constraints of maturity and minimum outstanding par value. See https://ecommerce.barcap.com/indices/index.dxml for more information.

The CBOE Volatility Index (VIX) is an up-to-the-minute market estimate of expected volatility that is calculated by using real-time S&P 500 Index option bid/ask quotes. The Index uses nearby and second nearby options with at least 8 days left to expiration and then weights them to yield a constant, 30-day measure of the expected volatility of the S&P 500 Index. FTSE Real Estate Indices (NAREIT Index and EPRA/NAREIT Index) includes only those companies that meet minimum size, liquidity and free float criteria as set forth by FTSE and is meant as a broad representation of publicly traded real estate securities. Relevant real estate activities are defined as the ownership,

HFRI Monthly Indices (HFRI) are equally weighted performance indexes, compiled by Hedge Fund Research Inc. (HFX), and are used by numerous hedge fund managers as a benchmark for their own hedge funds. The HFRI are broken down into 37 different categories by strategy, including the HFRI Fund Weighted Composite, which accounts for over 2000 funds listed on the internal HFR Database. The HFRI Fund of Funds Composite Index is an equal weighted, net of

J.P. Morgan’s Global Index Research group produces proprietary index products that track emerging markets, government debt, and corporate debt asset classes. Some of these indices include the JPMorgan Emerging Market Bond Plus Index, JPMorgan Emerging Market Local Plus Index, JPMorgan Global Bond Non-US

Merrill Lynch high yield indices measure the performance of securities that pay interest in cash and have a credit rating of below investment grade. Merrill Lynch uses a composite of Fitch Ratings, Moody’s and Standard and Poor’s credit ratings in selecting bonds for these indices. These ratings measure the risk that the bond issuer will fail to pay interest or to repay principal in full. See www.ml.com for more information.

Morgan Stanley Capital International – MSCI is a series of indices constructed by Morgan Stanley to help institutional investors benchmark their returns. There

Russell Investments

S&P 500 Index consists of 500 stocks chosen for market size, liquidity and industry group representation, among other factors by the S&P Index Committee, which is a team of analysts and economists at Standard and Poor's. The S&P 500 is a market-value weighted index, which means each stock’s weight in the index is proportionate to its market value and is designed to be a leading indicator of U.S. equities, and meant to reflect the risk/return characteristics of the

Information on any indices mentioned can be obtained either through your consultant or by written request to information@feg.com.