Have you ever wondered about the purpose of investing? Is it simply to maximize financial returns or do our investments provide impact in other areas of life?

Faith-based investors who pursue investing solely for financial gain can potentially experience a disconnect from their values. By practicing investment stewardship and selectively choosing investments that match one’s values rather than simply seeking profit, an investor can establish a double-bottom line: to seek returns while also working to have a positive impact on the world.

FEG has guided faith-based investors for decades, focusing on achieving excellence as fiduciaries and stewards of clients’ investment assets. This paper sheds light on faith-based investing as a philosophy of aligning faith-based values and investments.

Introduction

When considering the purpose of investing, most investors learn to prioritize profit maximization. A common theme underlying that philosophy for faith-based investors is to then use the profits from investments to support personal interests or the mission of the faith-based organization.

As stewards of capital, all investors have the opportunity to consider questions of value alignment and investment impact. Increasingly, investors are recognizing the importance of investment stewardship, and those with a faithbased worldview are discussing how to achieve greater alignment of their beliefs and investments. Fortunately, the opportunity to act on decisions to align investments with faith-based values has never been more achievable due to the growth in investment options and data to measure alignment with goals.

According to a January 2020 survey, Engaging Faith-Based Investors in Impact Investing by the Global Impact Investor Network (GIIN), faith-based investors tend to pursue low-risk, market-rate investments and rely heavily on their investment advisors to guide strategies. While uptake of impact investing has been limited, many faithbased investors have utilized strategies such as negative screening and shareholder advocacy to remove certain companies or industries from consideration or to push for change around certain issues. Collaboration among faith-based and secular impact investors can amplify shared values, even across faiths.

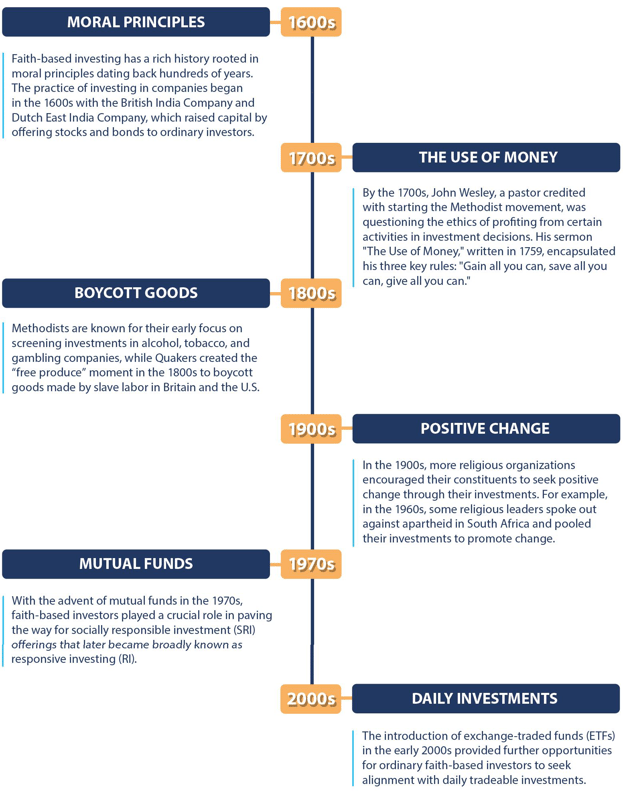

History

Faith-based investing has a rich history rooted in moral principles dating back hundreds of years. The practice of investing in companies began in the 1600s with the British India Company and Dutch East India Company, which raised capital by offering stocks and bonds to ordinary investors. By the 1700s, John Wesley, a pastor credited with starting the Methodist movement, was questioning the ethics of profiting from certain activities in investment decisions. His sermon The Use of Money, written in 1759, encapsulated his three key rules: "Gain all you can, save all you can, give all you can."

Methodists are known for their early focus on screening investments in alcohol, tobacco, and gambling companies, while Quakers created the “free produce” moment in the 1800s to boycott goods made by slave labor in Britain and the U.S.

In the 1900s, more religious organizations encouraged their constituents to seek positive change through their investments. For example, in the 1960s, some religious leaders spoke out against apartheid in South Africa and pooled their investments to promote change.

With the advent of mutual funds in the 1970s, faith-based investors played a crucial role in paving the way for socially responsible investment (SRI) offerings that later became broadly known as responsive investing (RI). The introduction of exchange-traded funds (ETFs) in the early 2000s provided further opportunities for ordinary faithbased investors to seek alignment with daily tradeable investments.

Faith-Based Investors Within the Current Landscape

FEG views faith-based investing as a unique and growing segment of investors within the broader umbrella of RI, which aligns an investor’s investments with their values. Other terms under the RI umbrella include environmental, social, and governance (ESG) investing, which has garnered tremendous attention over the last decade; SRI; impact investing; and sustainable investing.

Investors seeking faith-based investment can draw inspiration and values from guidelines such as the United Nations Principles of Responsible Investing’s (UNPRI) 17 Sustainable Development Goals (SDGs). Alternatively, investors can define their own faith-based investment goals, taking into account their specific religious beliefs. Although there can be much overlap in goals, guidelines and opportunities to collaborate in areas of interest, there is no single definition of values-based investing. Each faith-based group should consider their defined religious values and how best to evaluate investments relative to those virtues.

Faith-based social return criteria can include environmental interests, moral values or boundaries, and investing for the common good. A sound governance decision process must include whether to seek market-like returns or accept concessionary returns as part of the social impact factor. For example, some impact investments may result in lower-than-market-rate returns, as the social impact is considered more important than the financial return.

A key factor in considering faith-based investment guidelines is asking what services, products, or activities the investor does not want to profit from as they seek returns on investment. Determining the foundation of their worldview and how to best deliver on goals for investment stewardship without sacrificing financial returns will guide investors in their quest to be knowledgeable, enthusiastic stewards of the investments.

Which investments might be most suitable for a given faith-based investor can vary based on the principles of an investor’s faith. Religious teaching on values and potential guidance on investments have become more readily available, providing direction on how to best integrate faith principles with investment policy. Some faiths have centrally organized governing bodies that provide clear investment guidelines for all adherents, such as the Vatican or U.S. Catholic Council of Bishops (USCCB), while other religious groups may see varying approaches across the group.

FEG has experience serving many faith-based clients, advising investors across a wide range of faith groups. Depending on each group's unique mission, FEG utilizes this broad range of experience to create strategic investment guidelines. Clients of various backgrounds include:

Industry Trends

While industry studies on faith-based investing are limited, there is ongoing evidence of faith-based investment activity and FEG expects to see continued growth in this area going forward.

Faith Driven Investor (FDI) and Faith Driven Entrepreneur (FDE) are examples of Christian non-profit ministries that have grown rapidly. They feature educational websites and resources designed to provide content, community, and connections. FDI’s activities are aimed at inspiring, educating and mobilizing faith-based investors in the marketplace. Resources include podcasts, blogs, books, community groups, conferences, newsletters, and a marketplace for investment managers to promote their strategies. To date, FDI has produced nearly 150 podcasts on topics ranging from the importance of faith driven investors, to interviews with experts on a wide range of investment opportunities around the world, including: fund managers focusing on human flourishing or biblically responsive solutions, new business accelerators for entrepreneurs, filmmakers, and media teams promoting positive stories of redemption, family office investing, multi-family housing with life counselors on-site for tenants, and a range of venture capital opportunities.

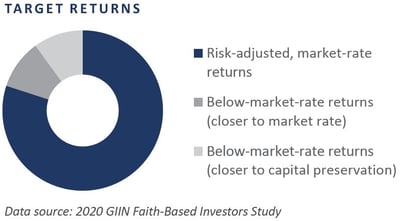

The GIIN paper, Engaging Faith-Based Investors in Impact Investing, suggested the universe of faith-based investors is diverse and most are pursuing market-rate strategies. While the survey was only comprised of 33 respondents, the findings were interesting and remain relevant to today’s faith-based investor. Of those surveyed, 82% targeted riskadjusted market rate returns in their portfolio, intending to use returns to fund programmatic work or retirement plans.

The paper illustrated that the majority of the portfolio assets were invested in public equity/debt markets due to the desire to pursue lower-cost, lower-risk investment solutions. Investing in private markets was less common, perhaps due to information being less available, higher costs and/or limited track records, which may deter some faith-based investors.

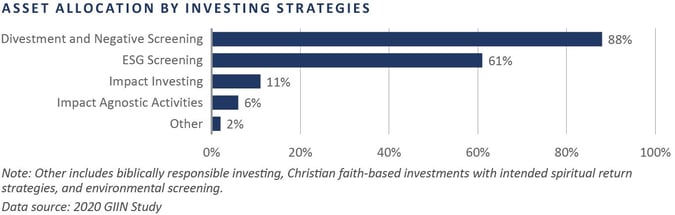

As previously noted, the most common approach for implementing a faith-based investment strategy is via screening of undesired companies or the divestment of certain industries. The GIIN study saw similar results, with 88% of respondents indicating they integrate this approach. While ESG has overlap with some faith-based goals, it does not fully align with the values of all faith-based investors, which is reflected in the data on asset allocation by investment strategies.

Reasons provided for the lower allocations to impact investments include:

- Smaller groups may be focused on advancing their faith through programs and activities via worship service, community outreach to underserved in their region, and directly engaging their congregations.

- Limited information or experience with impact investments.

- Limited impact investment opportunities/funds given the unique nature or interest of each investor group.

- Desire to focus on market rates of return.

- Relatively small sample size of the survey.

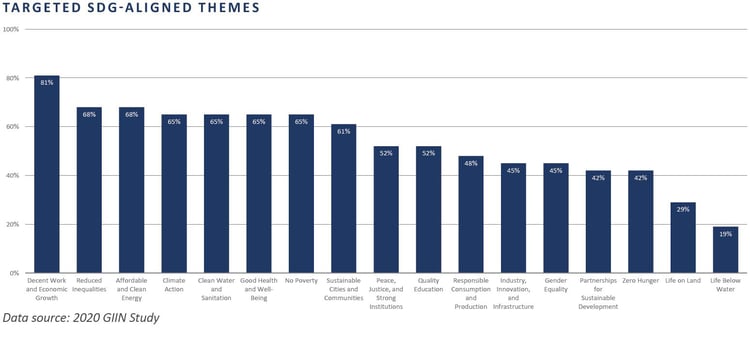

Most faith-based investors have their own unique guidelines. For comparative purposes, GIIN asked respondents how closely they align with the United Nation’s SDGs for comparative purposes.

Defining Process and Guidelines

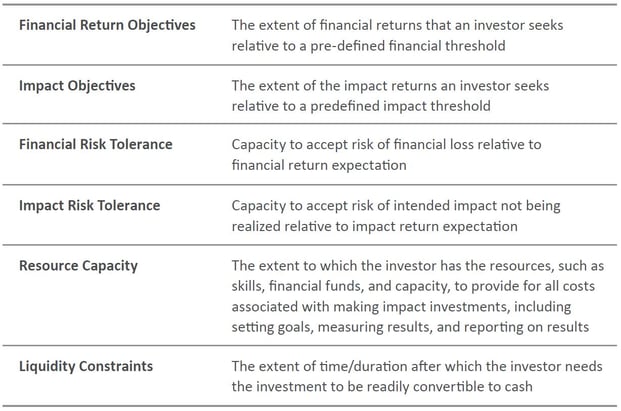

Establishing investment guidelines is a crucial first step in aligning an investor’s financial goals with their values. This involves education on defining goals, risk tolerance, and guidelines. As investors consider financial alignment with their values, it is important to remember investing is a mechanism through which individuals and organizations supply capital to support businesses and participate in their profits. Therefore, it is crucial to consider factors such as time horizon, risk tolerance, and liquidity needs while also keeping in mind one's faith-based guidelines and goals.

FEG leads the investment strategy discussion through a discovery process and facilitates decision-making with faith-based investors to define their financial and social goals in accordance with their faith-based lens and measure their progress towards achieving those goals. These discussions are crucial in guiding the investment decision-making process and ensuring investments are in alignment with stated values.

Of late, some institutions have been updating their investment guidelines to reflect their view of how their faith should be integrated into the modern world. For example, the USCCB guidelines, which were originally published in 2003, were revised in 2022 to reflect current values and priorities.

Investment managers also serve an important role in encouraging and delivering on a faith-based approach. One example is a manager that emphasizes stewardship of the natural world, incorporating principles of environmental sustainability and human flourishing into their investment philosophy. The philosophy can be summarized as a call to:

- Cultivate: To discover and develop the latent potential of creation and to bring forth civilization

and culture. - Keep: To cherish and safeguard the beauty and goodness of creation.

- Serve: To love one’s neighbors and care for creation.

Implementation

Investors have different methods at their disposal to align their investments and values. The most common method is exclusionary screening, which involves avoiding companies or industries that do not align with an investor's values. This approach is useful for investors who wish to abstain from making profits from companies they consider inappropriate. Faith-based investors can establish thresholds for unacceptable activities (e.g., 0%, 5%, 10% of revenue) and screen accordingly. Other methods include proactively seeking out investments that promote values aligned with one’s faith or purchasing individual securities in companies one wishes to see change their behavior and by engaging in shareholder resolutions.

“Shareholder engagement” refers to all the ways shareholders can influence the companies in their investment portfolios, including proxy voting, shareholder dialogue, and shareholder proposals.

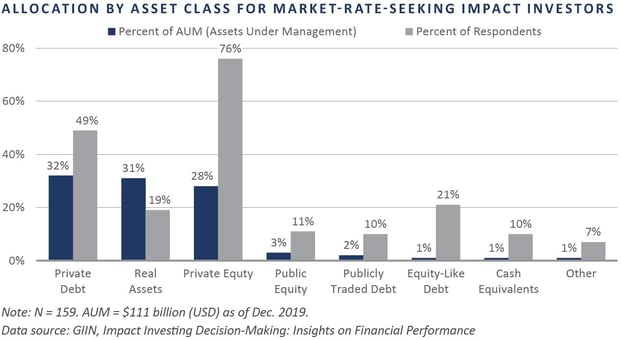

Impact investing involves making purposeful investments to help achieve social and environmental benefits while generating financial returns. In a follow-up paper on this topic, GIIN published findings in February 2021, titled Pursuing Faith-Based Impact Investing: Insights on Financial Performance, to offer further insight on impact investing. Though not all respondents were faith-based groups, the survey included a larger universe of 159 investors with an estimated $111 billion in invested assets.

Regarding insights on financial performance, the GIIN 2021 survey reported the following:

“Ninety percent of market-rate-seeking impact investors were pleased with the financial performance of their impact investments; nearly three-quarters of respondents (71%) reported performing in line with their financial expectations and another 19% reported outperforming relative to their financial expectations. About eight in ten respondents (81%) indicated performing in line with impact expectations. While only 10% of respondents reported underperforming on their financial expectations, none reported underperforming relative to their impact expectations.”

We believe this suggests that investors have been satisfied overall with their goals for a double bottom line in aligning investments with their financial goals.

When defining success for impact investments, the following elements can be integrated into the decision-making process and measurement of goals to help ensure alignment.

Liquid Investment Options

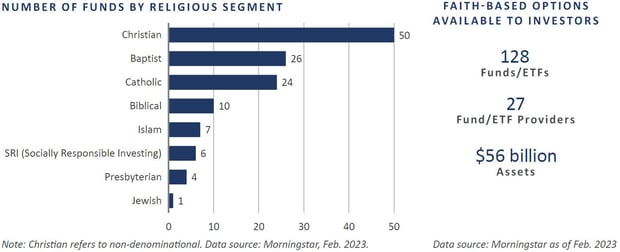

Faith-based investors have a wide range of options to choose from when it comes to aligning their investments with their values. These options include mutual funds, ETFs, separately managed accounts, and private investment managers that specialize in providing faith-based investment management. Morningstar’s recent review of faithbased mutual funds and ETFs illustrates the universe available to most investors.

Measuring Outcomes

To help investors measure the impact of their investments, FEG provides access to a growing list of data providers. While there is no standard methodology for measuring impact, and results may conflict across data providers, transparency has increased and the ability to develop and review impact reports has improved significantly. As investor interest in impact investing continues to grow, FEG expects the ability to measure impact in ways that are meaningful to individual investors and will also continue to improve.

Conclusions and FEG Solutions

Faith-based investing has a long history of promoting positive social change and human flourishing through community outreach, programs, and investments. Today, there is both significant interest and ample opportunity to align investments with unique values.

FEG believes investors can achieve both fiduciary excellence and stewardship by incorporating their faith principles into their investment program. With the increasing availability of investment products like mutual funds, ETFs, separate account customization, and private funds, the ability to align investments with faith-based values has never been greater.

FEG has extensive experience in guiding investors through the process of implementing faith-based portfolios and can provide customized solutions tailored to individual values and beliefs. Please contact us should you have any questions or would like to explore this topic further.

RESOURCES

The following resources were used to guide this research paper.

Christian History Institute

Eventide Center for Faith and Investing

Faith-Driven Investor

Global Investors Impact Network (GIIN)

The Resource Center for Religious Institutes (RCRI)

United Nations: Sustainable Development Goals

DISCLOSURES

This report was prepared by Fund Evaluation Group, LLC (FEG), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it.

Neither the information nor any opinion expressed in this report constitutes an offer, or an invitation to make an offer, to buy or sell any securities.

Any return expectations provided are not intended as, and must not be regarded as, a representation, warranty or predication that the investment will achieve any particular rate of return over any particular time period or that investors will not incur losses.

Past performance is not indicative of future results.

This report is prepared for informational purposes only. It does not address specific investment objectives, or the financial situation and the particular needs of any person who may receive this report.

Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directed to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202 Attention: Compliance Department.