Implementing DEI in Your Portfolio

Diversity, Equity, and Inclusion (DEI) has become a headline topic for nearly every industry. Asset owners are increasingly paying more attention to racial and gender equity in the context of who is managing their investments. Consequently, asset owners are also considering how they can have an impact in underrepresented communities through their investment portfolios. Examples include investing with emerging minority asset managers or investing in private impact strategies targeting economic growth through job creation.

This piece will walk through the implementation steps—whether your organization is considering DEI for the entire portfolio, as a specific percentage of the portfolio, as a silo, or as an impact solution. FEG can assist with every step along the way, serving as an important DEI resource for your committee, staff, and organization.

FEG and DEI

Diversity, Equity, and Inclusion are core elements of FEG’s culture of respect and excellence, as we believe a diverse group of professionals is more likely to achieve results than a homogenous one. We further believe equity provides positive outcomes for everyone and that an inclusive environment fosters a happier, more connected workforce, which ultimately leads to better outcomes.

As DEI is important to FEG, we also recognize its importance to our clients. We have seen tremendous growth in conversations related to DEI from varying client types, including community foundations, family offices, and university endowments.

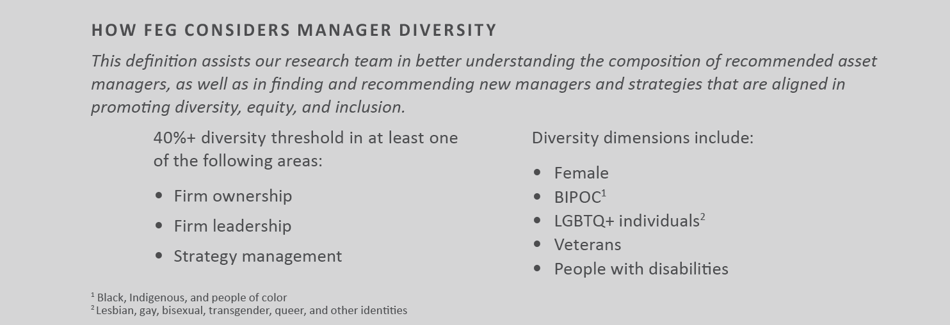

To formally track and disclose our efforts, FEG established a Diverse Manager Committee to help improve our understanding of diversity in asset management, with the goal of promoting the inclusion of underrepresented groups. Since a standard industry definition of diversity does not currently exist, the committee formulated FEG’s definition for assessing asset managers.

PART 1: Setting Objectives—The Discovery Process

What is Your Mission?

Does your organization’s mission explicitly address social inequity by either broadly or specifically targeting gender equality or racial justice? Has your organization considered how to address its mission through its investment actions? If your organization’s mission statement does not explicitly contain DEI language, strategic adaptations can be made to include social considerations while avoiding the complexities of “mission creep,” or expanding an organization’s mission beyond its original goals. Defining your objective is paramount to successful DEI implementation as a fiduciary.

Find Common Ground

The first step in implementation is also often the most challenging: finding common ground. Do the investment committee, staff members, and board members agree that DEI should be an investment consideration and, if so, what DEI criteria should be considered?

FEG can help align interests and outcomes (such as the organization’s definition of diversity) and ensure the organization’s portfolio is aligned. To assist in answering these questions, we share with clients our internal online survey dedicated to DEI-related issues that committee, staff, and/or board members can complete. Although individual responses are anonymously recorded, FEG will aggregate responses for an advisor-led debriefing session to determine where the common ground lies.

Give Yourself Permission

Next, we will assist in updating the organization’s investment policy statement (IPS) to include the appropriate language regarding DEI within the context of the organization’s investments, including allocating to diverse managers or diversity impact solutions, consistent with other investment objectives.

PART 2: Developing Strategy

Know Who is Managing Your Portfolio and What is in Your Portfolio

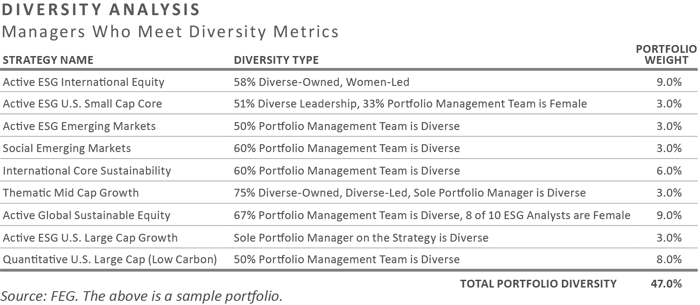

Before making big changes to your portfolio, it is important to assess the portfolio’s current manager and strategy composition. The combined efforts of FEG’s research team and Diverse Manager Committee can assess the diversity of a portfolio through the lens of your organization’s definition of diversity or using FEG’s definition. From there, we can help you create a timeline for portfolio implementation.

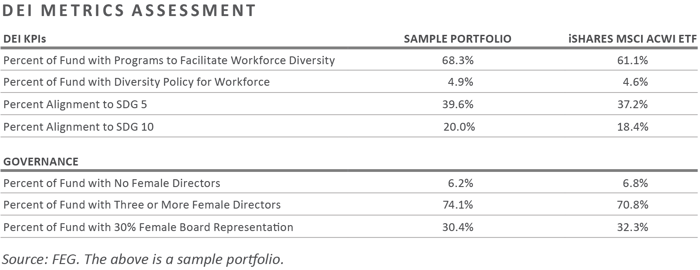

In addition to assessing asset managers and the strategies they manage, FEG also has the capacity to assess DEI-related key performance indicators (KPIs) of underlying companies within a given strategy. Examples include the percentage of underlying companies with diversity policies for their workforce or programs to facilitate workforce diversity, as well as companies’ board of directors’ diversity composition. We can also assess a portfolio’s alignment to the United Nations’ Sustainable Development Goals (SDGs), specifically to Goals 5 and 10—gender equality and reduced inequalities—which speak directly to DEI.

PART 3: Implementation

Portfolio Construction

There are multiple approaches for implementing DEI in a portfolio:

- Build an entire portfolio populated with diverse-owned or -led firms or diverse-managed strategies

- Set a challenging but achievable target of a percentage or dollar amount of the portfolio allocated to DEI firms or strategies

- Build a standalone “silo” portfolio of diverse-owned or -led firms or diverse-managed strategies

- Take a gender lens or racial justice approach to specifically focus on gender equality or racial justice in the entireportfolio or in a percentage of the portfolio

- Invest in impact solutions targeting underrepresented minority communities

- Take an ad-hoc approach and investigate the landscape and consider investment opportunities as they emerge

- Implement a “Rooney Rule.” Originally implemented in the National Football League, this rule requires at least one woman and one underrepresented minority to be considered in the slate of candidates for every open position. In this case, at least one strategy in each investment search will have a DEI component.

Does your organization have a timeline for implementation or an end goal to achieve the target level of diversity?

FEG can customize a portfolio restructuring plan based on your objectives.

PART 4: ONGOING MANAGEMENT

Monitoring

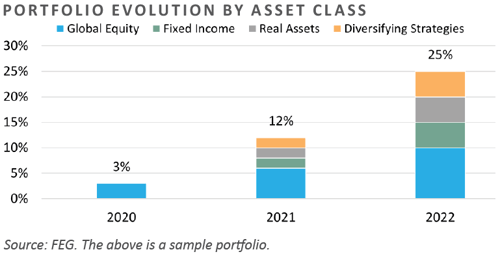

The DEI implementation process will most likely not happen overnight. The FEG team monitors the progress of your portfolio and sends formal updates on achieving the targeted level of diversity, both in terms of who is managing the portfolio and what is being included in the portfolio.

An example of a progress update on portfolio management includes a breakdown of contribution of DEI by asset class. Making incremental changes to the portfolio over time can substantially increase the level of diversity in a portfolio.

For an update on what is being included in the portfolio, we can report on DEI KPIs measured in the portfolio—from the DEI metrics assessment—and deliver an impact report annually, or as frequently as desired.

CONCLUSION

FEG recognizes the difficulty in achieving the “perfect” portfolio and that, as with any investment endeavor, the first step is typically the most challenging. Although it may seem difficult, once you start working towards this goal, the process quickly becomes more manageable. Taking the first step is the most important because it signals the commencement of your organization’s journey towards mission- or interest-alignment.

In conclusion, the process of implementing DEI in your portfolio is remarkably similar to other portfolio construction processes in that a targeted, thoughtful, and methodological approach will typically yield the best results. FEG is here every step of the way to field your questions and aid your organization in the implementation process.

DISCLOSURES

This report was prepared by FEG (also known as Fund Evaluation Group, LLC), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directly to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202, Attention: Compliance Department.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it. FEG, its affiliates, directors, officers, employees, employee benefit programs and client accounts may have a long position in any securities of issuers discussed in this report.

Neither the information nor any opinion expressed in this report constitutes an offer, or an invitation to make an offer, to buy or sell any securities.

Past performance is not indicative of future results.

This report is prepared for informational purposes only. It does not address specific investment objectives, or the financial situation and the particular needs of any person who may receive this report.

Published November 2021