As events continue to evolve, we will provide updates with information related to the impact on markets and the unfolding banking crisis.

We also want to remind investors that bad actors rarely miss an opportunity to strike. Phishing attempts with fraudulent wire instructions occurred when Silicon Valley Bank experienced its crisis in March. We would not be surprised if similar activity were to occur with First Republic Bank. FEG recommends verifying wire instructions with the manager before funding capital call requests.

Please reach out to your FEG contact with any questions.

May 1, 2023 Update: First Republic Bank

The markets opened Monday morning to the news that regulators seized First Republic Bank (FRB) and sold most of its assets and operations to JPMorgan Chase. Today’s event marks the third U.S. bank to face a crisis this year, following the collapse of Silicon Valley Bank and the seizure of Signature Bank.

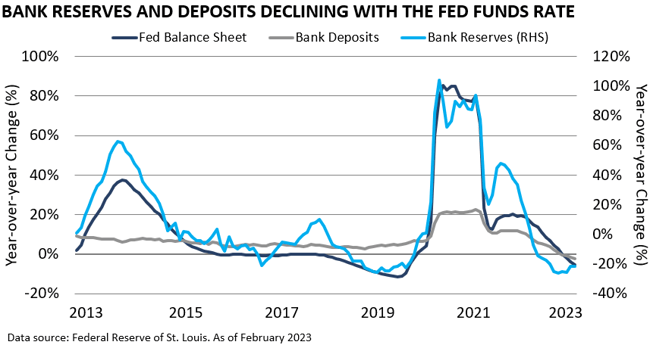

The market had been eyeballing FRB for a few months after a cadre of 11 banks injected $30 billion in deposits to the teetering institution in mid-March. Similar to Silicon Valley Bank (SVB), FRB served a high-end clientele with high-touch, concierge-style service while granting these large depositors favorable terms on low loan-to-value personal mortgage loans. Although the borrowers’ credit remains solid and the mortgages are performing, FRB’s large depositors began seeking 4% money market rates away from FRB, resulting in a $100 billion exodus of deposits in March. For context, JPMorgan will buy the remaining $92 billion FRB deposits. This means over half of FRB’s deposits have left for greener interest-rate pastures this year.

FEG monitors the banking relationships that our investment managers maintain to run their firms and respective funds. SVB and FRB were—far and away—the two banks of choice for venture capital and small private equity general partners (GPs), so we have already witnessed an across-the-board changing of the guard in banking relationships.

We are now seeing GPs diversify their exposures. There was considerable uncertainty in the days after the SVB collapse on capital flow machinations as regulators scrambled to bring the situation under control. Since then, it has become best practice for general partners to diversify their banking relationships and sweep excess cash into other accounts such as money market accounts or U.S. Treasuries.

Although the news of the takeover is still fresh, we would expect to see less operational uncertainty given the recent banking relationship realignment. However, there could be some impacts on the timing of capital calls for those most directly impacted by operational changes.

March 17, 2023 Update: A Banking Crisis, Explained

As the banking crisis continues into a third week, we wanted to provide additional insight on the continually evolving Banking Crisis, including how a boutique bank in California, and a global bank headquartered in Zurich, Switzerland can be linked.

Banking, at its essence, is simple. Banks take in deposits from savers and, in turn, make loans. Savers get a safe place to hold excess cash and earn interest on their deposits. Banks take those deposits, set aside a small reserve in safe, low-risk bonds, and lend those funds. Ideally, banks lend those funds at higher interest rates than what they are paying the savers, which is known as the net interest margin. Finally, because those loans often have a longer length (duration) than the deposits, the bonds must be liquid. Most of the time, banks hold those reserves in Treasuries and Agency Mortgage-Backed Securities.

Modern banking has grown complex. Not only have the products offered become more complicated (Think subscription lines offered by Silicon Valley Bank to venture capital firms), the banking regulation has as well. In the aftermath of the 2008 Great Financial Crisis (GFC), a patchwork of new regulations emerged; some have been modified, some rolled back, and some enhanced in the following years. Also, banking is built on positive interest rates and an upwardly sloping yield curve. What does this mean? In short, the longer deposits are locked up, the higher interest rates should be. In theory, a 5-year certificate of deposit (CD) should pay more than a 6-month CD. Also, a new phenomenon is the zero-interest rate environment that started with the GFC and was further enacted during COVID. It is hard for banks to survive when that net interest margin is small or even negative.

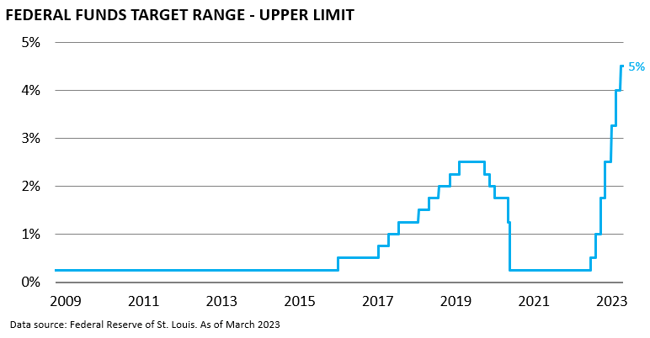

To answer the question of how Silicon Valley Bank and Credit Suisse are linked…the answer is Central Banks. The low-to-zero interest rate policy implemented globally stayed in place (too long) until inflation rose its ugly head. As soon as inflation emerged, Central Banks were forced to pivot to a higher interest rate environment in the hopes of quelling inflation.

If low-interest rates are bad for banks, wouldn’t higher rates be better?

Yes, and no. Yes, eventually, higher rates are better environments for banks to operate. However, the transition to higher rates can be painful. The current interest rate-rising cycle has been one of the fastest and steepest in history. Imagine a bank that used its reserves to purchase U.S. Treasuries a few years ago in that low-interest rate environment. Let’s say when purchased, a Treasury had a face value of $1,000 and yielded 2%. If interest rates rise to 4%, who would want a U.S. Treasury paying 2%? To reflect that, the principal amount of the original security must decline enough to offer a comparable yield.

Again, modern banks have grown complex. The example above is what is happening to most bank reserves globally. While they are safe from a credit perspective (Treasuries, Agency Mortgages), they do carry interest rate risk. During the low-rate environment, banks used their reserves to find the highest-yielding “safe securities” to attract deposits and earn a positive interest rate margin. The longer in duration, the more interest rate risk you create.

Modern bank regulations created two accounting treatments for bank reserves. One is called Available-For-Sale, while the other is Hold-To-Maturity. Those reserves that you will likely need in the short term must be marked-to-market. So, when rates rise, you are marking down the value of your bonds. Hold-to-Maturity is a special category for those holdings that you never expect to sell. Therefore, they are not marked-to-market. They are held at the same value that they were purchased at (even though, in theory, they are worth less).

Enter a bank run. Silicon Valley Bank reached for extra yield and extended its duration. This was great for profits, but it created acute interest rate risk. When they started having some liquidity issues, they were forced to move securities from the Hold-to-Maturity category to Available-for-Sale category. In doing so, they would need to value those securities lower, creating an asset write-down. Then the run became an avalanche. In modern society, information is disseminated at the speed of social media. In the case of Silicon Valley Bank, a large bank user went on Twitter to say he was pulling his accounts.

Markets shoot first and ask questions later. As soon as the issues became public, the market started to ask who else may have this same issue? Domestically, the focus moved to First Republic and Signature Bank, but all community and regional banks have come under pressure. In Europe, where interest rates were not just zero, but at times negative, investors also began to look for the weak links. They settled quickly on Credit Suisse, and to a lesser extent, Deutsche Bank.

Financial markets operate on trust, and that trust has been shaken. Globally, regulators have responded quickly. Whether or not it will be effective in the long run is still to be determined. They have provided liquidity and a back-stop to depositors. What they have not provided was effective communication. Both Federal Reserve Chairman, Jerome Powell, and Treasury Secretary, Janet Yellen, have made statements regarding how broad their rescue powers would extend that they have had to walk back several times. European regulators have been similarly ineffective in speech. A crisis can unfold and evolve in unpredictable ways. What we do know is at this juncture that this is more about liquidity and interest rate risk than credit quality, at least for now. This is very different from the 2008 crisis. Also, at least stateside, our biggest banks seem to be the healthiest. In fact, they have been helping other smaller banks by making large deposits. This is also different than 2008. When will this end? We do not know. How this ends, we do know. It will end when trust is restored.

Until that time, FEG will vigilantly monitor our underlying managers and markets.

March 17, 2023 Update: SVB Declared Bankruptcy

Silicon Valley Bank (SVB) declared bankruptcy this morning. While not a great headline, this was an expected Chapter 11 re-organization versus a liquidation. SVB is fully operational, and clients can access all of their cash. The reality, however, is that many asset managers have already established accounts with new financial institutions. It is a similar story for Signature Bank and First Republic; they remain backstopped and operational, although many managers have likely moved their accounts elsewhere. As we continue to navigate through these changes and updates, FEG maintains active dialogue with all of our recommended managers.

In addition to SVB, Credit Suisse and its relationship with hedge funds has been a question for some clients. Globally, Credit Suisse has had issues for years. Since their losses with Archegos Capital Management in 2021, they have largely exited the prime brokerage business. Prime brokerage is a suite of services offered to hedge funds, including the ability to borrow securities and provide leverage. Also, following the Lehman Brothers collapse, hedge funds all have multiple primes. Thus far, there has not been any material exposure.

Ultimately, capital markets function on trust. That trust has been shaken. While markets may continue to sell off under the weight of financial issues, this is not 2008. During the Great Financial Crisis of 2008, our biggest banks were at the epicenter of the crisis. Today, our largest banks are the same ones helping to stabilize the system (as with the injection of deposits into First Republic). The current situation at hand has primarily been an issue with small bank unique business models, especially those with large exposures to venture capital and crypto-currency. It is also largely a liquidity issue, not an asset quality issue. In 2008, the government was slow to act. A defining change during the current crisis, is the government has moved quickly and effectively – preventing a crisis of 2008’s magnitude. While it is possible markets continue to decline in the near term, increasing the odds of a recession, this is not a 2008 redux.

March 13, 2023

Over the weekend, the Federal Reserve (Fed), the Federal Deposit Insurance Corporation (FDIC), and the Treasury Department stated that Silicon Valley Bank (SVB) depositors would have access to all deposits starting Monday.

Later, Signature Bank – a NY bank that was closed late Sunday evening in a preemptive act to avoid a bank crisis – was added to this mandate. While the blanket deposit coverage above the previous $250,000 FDIC coverage is applicable only to these specific banks, the Fed will also provide broader liquidity to any bank in need through a program called the Bank Term Funding Program. With this program, any bank can exchange “safe assets,” including U.S. Treasuries and government-backed mortgage bonds, for cash at par for up to a year. This allows banks to tap into liquidity without taking the market decline due to the increase in interest rates.

While the broader implications for the banking industry are still unknown, it is important to state that these were unique institutions that primarily serviced the venture and crypto-currency communities that were facing unique pressures.

Other implications are clearer:

Investors Should Be Vigilant Against Fraud

The speed and ingenuity of cyber criminals can be astonishing. It has come to our attention that some cyber criminals are using the issues at SVB to send out phishing emails offering new wiring instructions. While many are receiving valid emails from managers who have moved their accounts to new financial institutions, FEG encourages all clients to verify these instructions. We recommend a phone call or an email to a known address or phone number outside any offered within an email. It is always better to be safe than sorry.

A Likely Increase In Capital Calls

Investors are likely to see an increase in unplanned capital calls. SVB was a significant provider of subscription lines of credit to the private capital community. Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for irregular capital calls from the fund’s investors.

Any private capital manager with an outstanding line balance to SVB has no expedited requirements to pay that line quicker due to their change in status. This would be considered right-way risk. However, as many managers move those subscription lines to other financial institutions, new lenders will likely require outstanding balances with SVB to be paid off first. This request is likely to increase capital call activity.

Potential Impacts to Internal Rate of Return (IRR)

While one reason for using subscription lines is to provide operational efficiencies to investors, there is also a significant benefit for managers. Time has a major impact on the calculations of IRRs. For any given return, the less time needed to generate that return, the higher the IRR. Therefore, by delaying the client investment, one might increase the IRR. If subscription line lending becomes less frequent or balances are not allowed to be outstanding as long, the results may negatively impact industry IRRs. For this reason, it has historically been important, and is even more important now, to focus on multiples of invested capital (MOIC). Hence the old industry adage that one cannot eat IRRs.

March 10, 2023

Silicon Valley Bank (SVB) was closed today by the California Department of Financial Protection and Innovation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. SVB is a prominent bank within the venture capital and growth equity community. Many venture capital firms and venture-backed companies used SVB for deposits and lines of credit (LOC). This situation continues to evolve quickly. FEG will provide further updates as developments are clarified.

How We Got Here?

A combination of factors contributed to what was effectively a run on SVB bank, the 16th largest bank in the U.S. and marking the largest bank failure since the global financial crisis:

SVB experienced losses on its available-for-sale (AFS) securities, which reportedly included investments in CMBS securities. This created stress on the bank’s balance sheet.

An equity financing deal fell apart. SVB planned to raise $1.75 billion of newly issued common equity and convertible preferred securities along with a $500 million investment from General Atlantic, a long-time SVB customer. SVB was in a quiet period during this financing effort, which limited its ability to speak publicly as the situation evolved.

Customers, primarily technology companies, increasingly began making withdrawals. Venture-backed companies that used SVB would take the equity from their financing rounds and deposit the capital with SVB. These companies would then draw down this capital over time as they build their business and cover cash shortfalls.

Venture capital investment activity slowed. Venture funds pulled back on new investment deployment, which caused a reduction in new deposits at SVB.

Greg Baker, SVB’s CEO, held a call with venture firms on Thursday that did not have the desired impact. According to various reports and private capital managers, he urged clients to stay calm and not panic. The opposite happened after the call.

Following the call, withdrawal requests accelerated throughout the technology community, creating a run on the bank.

Customer Reaction

PE firms moved to open accounts for their firms and funds with other banks. Some firms have paused capital call notices until alternative banking relationships are in place.

VC-backed companies face a significantly different risk because their cash deposits with SVB were earmarked for running their business. These companies began the process of withdrawing capital from SVB yesterday. SVB accounts were frozen today and are now under the control of the FDIC.

Impact on SVB Clients/Constituents

PE Firms/PE Funds – PE firms and PE funds generally run close to breakeven. They usually have little to no cash or deposits at SVB. The PE firms and PE funds are more likely to owe SVB due to draws on their LOCs.

Venture-backed companies – SVB was heavily used by venture-backed companies. Companies would take equity capital received from venture funds and deposit those funds at SVB. The companies would make withdrawals as they built their business and to cover cash shortfalls, commonly referred to as cash burn or burn rates.

From the FDIC Today:

All insured depositors will have full access to their insured deposits no later than Monday morning, March 13, 2023. The FDIC will pay uninsured depositors an advance dividend within the next week. Uninsured depositors will receive a receivership certificate for the remaining amount of their uninsured funds. As the FDIC sells the assets of Silicon Valley Bank, future dividend payments may be made to uninsured depositors.

What Happens Next?

The FDIC insures deposits up to $250,000. These deposits will be available for withdrawal on Monday. It is not clear what “advance dividend” might mean next week. It does not appear that depositors will have access to amounts over $250,000 until the FDIC sells assets. PE firms are working with PE-backed companies to set up short-term capital solutions until this situation is resolved.

In Conclusion

FEG has been in touch with many of our recommended private equity fund managers throughout this situation. Please keep in mind that this is a real-time update in a rapidly evolving situation. We will provide additional updates as we gain clarity on the impact on client portfolios.

DISCLOSURES

This information was prepared by FEG (also known as Fund Evaluation Group, LLC), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directly to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202, Attention: Compliance Department.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it.