Flash Poll

FINDING COMMITTEE AND BOARD MEMBERS

One challenge many institutional investors share is how to find qualified investment committee and board members. To help understand the scope, drivers, and solutions of this challenge, FEG recently conducted a flash poll, the results of which are presented below.

FINDING NEW INVESTMENT COMMITTEE MEMBERS

|

|

49% Of overall respondents said their |

When asked where they typically seek out members for their boards and committees, most respondents cited their current board as the primary source, followed by citing those within their network in the investment or finance industry, and donors. However, only 30% of institutions have committee members who are also board members. This suggests that participating institutions often look outside their boards to source investment committee members. Additionally, those who indicated challenges in finding members to serve on committees and boards primarily indicated difficulty finding investment or finance committee members.

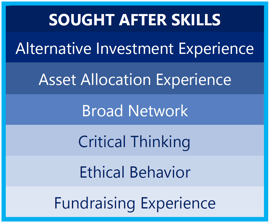

WHAT INSTITUTIONS LOOK FOR IN INVESTMENT COMMITTEE MEMBERS

According to nearly three-fourths of respondents, the most important trait or skill for an investment committee member to have is investment experience, followed by an understanding of the mission and goals of the organization. The most common traits sought are shown below.

75%

of participating respondents believe investment

experience is the most important factor in an

investment committee member

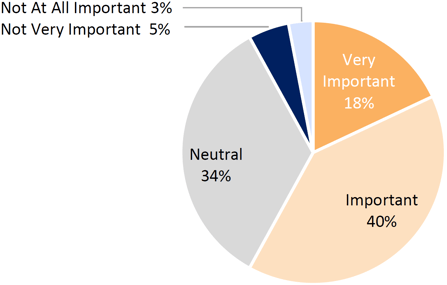

Respondents were also asked how important they thought diversity considerations were, in terms of race and gender, when selecting new investment committee members. Nearly 60% of respondents believe diversity considerations are important or very important when searching for members. Only 8% of respondents cited diversity considerations as not being an important factor in these decisions. Respondents from community foundations especially stressed the need for diversity within their investment committees, though some noted challenges in finding qualified diverse committee members within their communities, particularly individuals with investment experience.

IMPORTANCE OF DIVERSITY IN TARGETING NEW COMMITTEE MEMBERS

Source: FEG, n=65 |

58% of respondents believe |

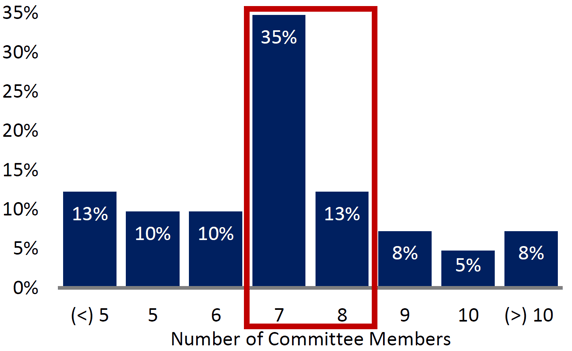

BOARD AND COMMITTEE SIZES VARY GREATLY

Both board and committee sizes varied dramatically among participating institutions, ranging from two members to 35 members. Boards tend to be larger, consisting of 17 members on average for all respondents to the flash poll.

Participating institutions utilizing both outsourced chief investment officer (OCIO) and traditional consulting models have similarly sized investment or finance committees, consisting of 7 to 8 members on average. This is interesting as institutions sometimes cite smaller committees as a reason for outsourcing their investment efforts.

These results are consistent with FEG’s most recent Community Foundation Survey, which showed that more than half of that survey’s respondents have between 7 to 9 investment committee members.

HOW MANY INVESTMENT COMMITTEE MEMBERS DO INSTITUTIONS HAVE ON AVERAGE?

Source: FEG, n=42 |

HOW THE PANDEMIC CHANGED BOARD/COMMITTEE MEETINGS

Finally, responses also indicated the on-going COVID-19 pandemic has played a role in how committees are meeting (virtually/in person) and even their composition. Some boards asked members to sign on to serve an additional year during the peak of the pandemic, to ensure proper governance and continuity in decision making. FEG also saw organizations add board and committee members that were not local to the institutions they serve on, as more organizations have offered hybrid meeting options to members.

YOU’VE IDENTIFIED YOUR NEW COMMITTEE MEMBERS – WHAT’S NEXT?

Just under half of respondents (47%) have a formal process for onboarding new committee members, including providing an overview of the investment policy statement (IPS), roles and responsibilities, investment philosophy, current portfolio composition and historical approach to portfolio construction, and performance. Two-thirds of those that do not have an onboarding process do not believe they need one; the remaining third indicated that the lack of resources/time are the reason they do not currently have an onboarding process in place.

For most organizations, this onboarding process is led by staff members, often the Chief Executive Officer (CEO) or president of the organization, with varying participation from Chief Financial Officers (CFOs) or directors of finance, and committee chairs. Respondents currently working with OCIOs cited reviewing the OCIO model at this stage as especially important.

FEG INSIGHT

While the number and composition of individuals around decision making tables varies across organizations, most institutions look to their boards and others within their networks with investment experience as potential investment committee members. For those organizations that struggle to find qualified investment professionals to serve on committees, there are a few options peers have explored, including: (1) expanding the list of requisite traits beyond investing (i.e., business professionals, general finance professionals); (2) recruiting non-local members given the prevalence of virtual and hybrid meetings; and (3) appointing a smaller committee, which can also be more efficient and make it easier to get consistent attendance.

Once an organization has determined who is sitting on governing committees, an equally crucial step is preparing committee members to serve in their respective roles. Onboarding of committee members continues to be an area of potential improvement for organizations, as many referenced materials that would be helpful in this process. In addition to preparing members for their first meeting, checking in at various stages of their term is also recommended, to ensure understanding of their responsibilities and fiduciary duty to the organization.

For those just beginning to build out their onboarding process, or those looking to improve on theirs, FEG recommends including the following as part of an Onboarding Investment Committee Packet:

- Investment Policy Statement (IPS)

- Spending Policy

- List of Committee Members and Backgrounds

- Committee Charter (if available)

- Sample Meeting Materials

- Performance History

- Investment Strategy History

FEG recognizes that governance structures vary across organizations and strives to assist organizations we work with in making better investment decisions and building effective investment committees. You can find more resources for governance topics here. If you or an organization you work with has questions related to investment committee governance, please feel free to contact us.

ABOUT THE SURVEY

FEG Flash Polls collect data from institutional investors across a wide variety of segments to provide insight on current topics. This poll looked at questions related to sentiment and actions taken related to hiring diverse asset managers, defining diverse managers, metrics used around tracking progress investing with diverse managers, and resources to learn more on the topic. FEG received responses from 82 participants, where 50% of respondents were staff. We would like to thank all survey participants for their contributions and hope they find the results valuable.

DISCLOSURES

This report was prepared by Fund Evaluation Group, LLC (FEG), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis.

Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directed to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202 Attention: Compliance Department.

Flash Poll results as of August 2022. FEG Flash Polls collect data from institutional investors across a wide variety of segments to provide insight on current topics. This poll looked at questions related to sentiment and actions taken related to hiring diverse asset managers, defining diverse managers, metrics used around tracking progress investing with diverse managers, and resources to learn more on the topic. FEG received responses from 82 participants, where 50% of respondents were staff. This Flash Poll was open February 21 to April 8, 2022 and participants were not charged a fee to participate in the Flash Poll.

Neither the information nor any opinion expressed in this report constitutes an offer, or an invitation to make an offer, to buy or sell any securities.

This report is prepared for informational purposes only. It does not address specific investment objectives, or the financial situation and the particular needs of any person who may receive this report.

Published August 2022.