We offer financial advisors and intermediaries access to a series of risk-managed, diversified portfolios to help investors meet their specific investment objectives.

Constructed of ETFs and mutual funds, these portfolios are managed through dynamic asset allocation decisions to overweight or underweight asset classes and take advantage of opportunities driven by valuation, market sentiment, or fundamentals.

Every portfolio seeks to benefit from FEG’s track record of researching, vetting, and selecting managers and strategies for our portfolios.

Core Portfolios

- Combination of Exchange-Traded Fund and mutual fund holdings

- Strong core portfolio solution

- $50,000 minimum

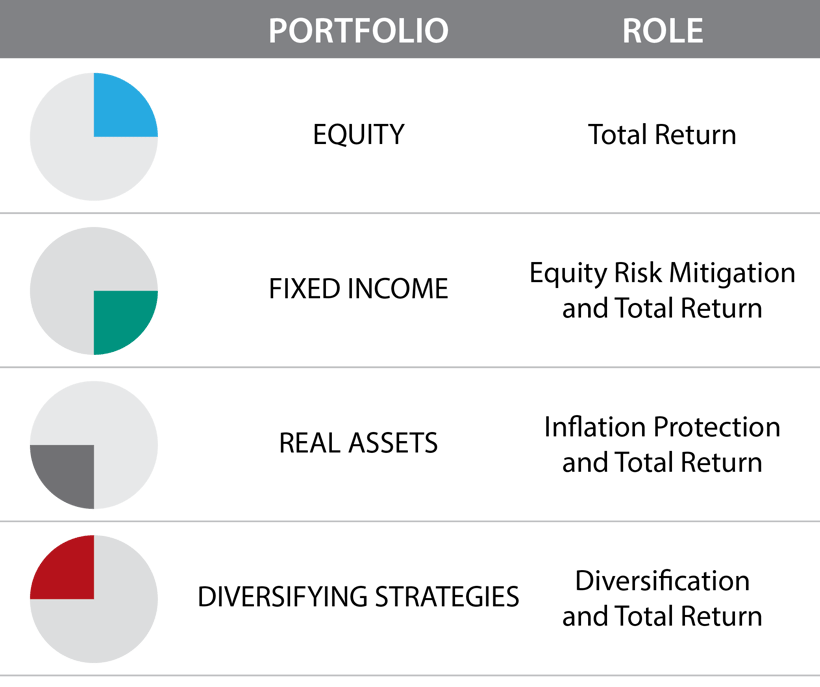

Category Portfolios

- Targeted exposure, part of broader portfolio

- Alternative asset classes

- Minimums:

- $25,000 (Real Assets, Diversifying Strategies)

- $50,000 (Equity, Fixed Income)

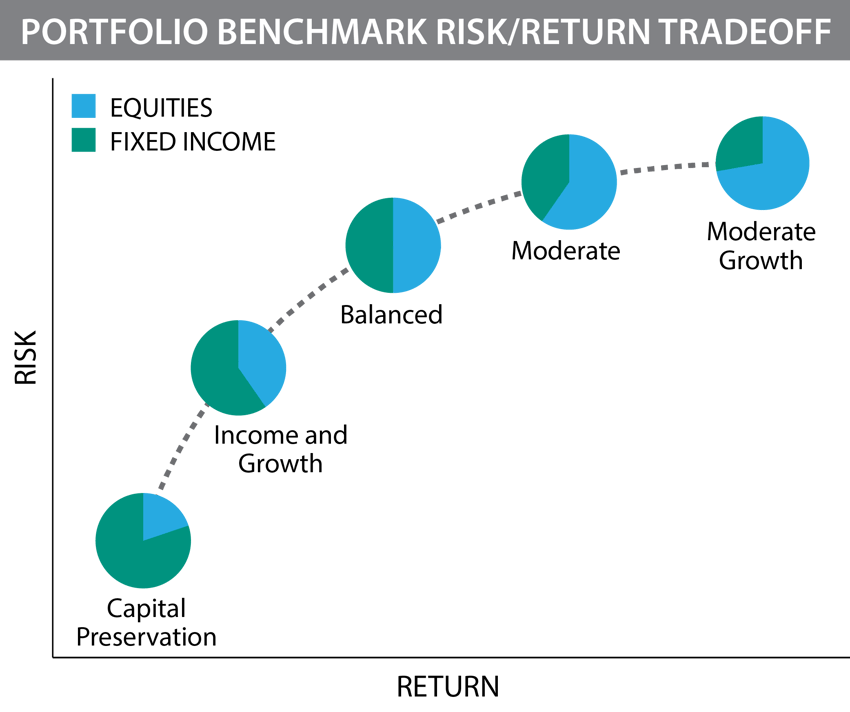

Source: FEG. For illustrative purposes only.

Source: FEG. For illustrative purposes only.

Other solutions include:

- Alternative Investment Strategies: Offered via our managed portfolios or as a standalone option

- Endowment Alliance Program (EAP): Tailor-made for advisors working with one of the millions of U.S. nonprofits that need sophisticated, institutional advisory solutions

- Outsourced Research Services: Custom research engagements tailored to the needs of clients—typically large registered investment advisors (RIAs), multi-family offices, or asset managers that value research but lack the resources to build robust capabilities of their own

Advantages of Managed Portfolios

- Experience and Independence: FEG has 30 plus years of experience and brings an institutional perspective and expertise to client portfolios while retaining independence as a 100% employee-owned firm.

- Dynamic vs Static Allocation: FEG seeks to add alpha through dynamic asset allocation decisions that overweight asset classes with an opportunity to outperform over the mid to long term. We seek to take advantage of opportunities driven by valuation adjustments, market sentiment, investment styles, market capitalization, and geographic exposure.

- Low-Cost Solution: Our portfolios combine both active and passive management. Passive management provides low-cost, targeted beta exposure, while active management seeks to provide higher-than-average returns.

We want to hear about your objectives.

Matthew J. Boyko

Sales Associate

Intermediary Solutions