ESG

We offer several OCIO options to support our clients’ viewpoint and mission—from issue-specific screening to complete ESG criteria integrated across several asset classes.

Discover your Starting Point

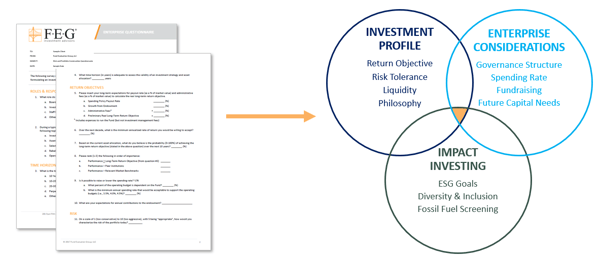

If you are considering Responsive Investing, it is important to understand committee, staff, and board views on the implementation, what the responsive investment should look like, and best ways to implement. Through our discovery process, we create a solid foundation of mutual understanding that leads us in crafting a unique investment program, tailored to your specific goals.

The unique investment program can be implemented broadly for the responsive investment umbrella, or specific to a section of Responsive Investing such as ESG, faith-based considerations, or selection of Diverse Asset Managers. After staff and committee members complete our survey, we share the results and walk you through the responses and next steps.

ESG Ranking

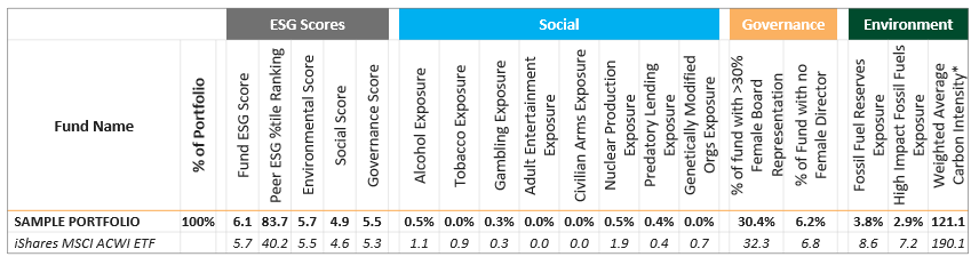

We rank our portfolio against the benchmark on both performance and ESG scores. It is our opinion that it is important to know what you own. For clients, we provide portfolio analysis of the ESG scores and how the portfolio rates compared to the benchmark on issues such as exposure to fossil fuels, carbon footprint, and 'sin stock' exposure.

SAMPLE ESG RANKING FOR PORTFOLIO VS. BENCHMARK

Data source: MSCI FundMetrics

FEG OCIO Portfolios

OCIO opportunities include discretionary ESG and religious portfolios with a track record or custom portfolios based on clients' objectives.

FEG OCIO ESG Portfolio Overview

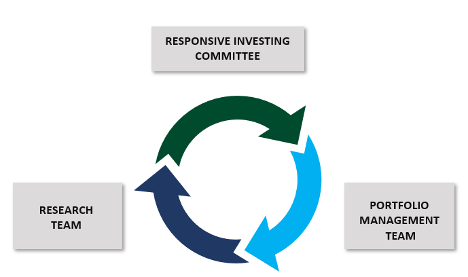

The portfolio provides a globally diversified solution of Environmental, Social, and Governance (ESG) focused funds, with approximately 60% allocated to equities and 40% allocated to fixed income. The criteria are integrated across several asset classes. FEG constructs a full portfolio populated with mutual funds and ETFs from several different fund families. We follow a holistic process involving our Research Team, Portfolio Management Team, and Responsive Investing Committee.

Our RI Portfolio Construction Process

The Responsive Investing Committee works with the Research Team to source ESG investment managers and strategies, which follow the same six-tenet review process used for all recommended managers.

In addition, the Responsive Investing Committee collaborates with the Portfolio Management Team to provide thought leadership and education, as well as monitor RI opportunities in the marketplace.

Lastly, we hold ongoing conversations with managers to review separately managed accounts are being actively screened.

Manager Research and Selection

FEG’s research team seeks to identify managers with experienced personnel, a sound investment philosophy, and a demonstrated ability to outperform. We evaluate each manager utilizing our six-tenet framework.

CONVICTION |

Strong belief in the investment philosophy; willing to put investment decisions ahead of business decisions; invests alongside of clients, aligning interests |

CONSISTENCY |

Stability of organizational structure, composition of investment professionals, and the investment philosophy and process |

PRAGMATISM |

Understand core strengths and have the ability to capitalize and sustain their competitive edge |

INVESTMENT CULTURE |

Strong ethical foundation, passionate about investing; proper organizational and compensation structure; culture pervades across organization |

RISK CONTROL |

Not blind risk takers, but risk conscious; acknowledge mistakes; robust and effective risk mitigation |

ACTIVE RETURN |

Ability to identify and profit from investment opportunities; successful track record |

In addition to meeting the six tenets that underlie FEG’s due diligence process, managers must demonstrate adherence to one of the following ESG mandates when investing in businesses.

LEVELS OF IMPLEMENTATION

Negative Screening

|

Avoidance from companies or industries based on ESG criteria (ex. tobacco, gambling, pornography, abortifacients). |

Positive Screening

|

Investing in specific sectors, companies, or projects with clear positive impact (ex. Identifying environment friendly company, clean technology, renewable energy, urban revitalization). |

Impact Investing |

Targeted investment aimed at solving social or environmental problems (ex. Bridge financing to local non profit organization, lending capital for revitalization). |

Thematic Investing |

Targeting specific strategies that mirror the values of the investor (ex. human rights, political contributions, economic development, etc.). |

Full ESG Integration |

Systematic and explicit inclusion of ESG criteria in the decision-making process to identify externalities and generate a better representative value of a company. |

Source: USSIF |

|

Manager Case Study

INFLUENCING CORPORATE POLICIES TO SERVE THE COMMON GOOD

Positive Screening and Activism

Background:

FEG recommends Boston Common, an experienced investment manager specializing in globally sustainable initiatives, for inclusion in FEG portfolios. As part of its regular activities, Boston Common uses the leverage of its investments in companies to actively participate in influencing corporate policies to serve the common good.

Results:

Boston Common communicates goals and milestones in its quarterly reports.

Impact:

One of Boston Common’s current goals is to hold companies accountable for their human rights policies and practices. To that end, Boston Common convened a roundtable in June to examine the role and responsibilities of investors in holding companies accountable for human rights policies and practices. Microsoft Corporation and Apache Corp. both offered their best practices in addressing human rights—from operations and suppliers all the way up to the boardroom.

Source: Boston Common International Equity. The purpose of the investment manager example shown above is to illustrate FEG's investment research and capabilities to search and recommend ESG strategies. This example has been used for that purpose only. Actual client portfolios will typically contain different investments than the example set forth, and accordingly, they should not be viewed as an indication of overall past or future portfolio performance.