Every organization will have different approaches, goals, and interpretations of Responsive Investing. At FEG, we start with a discovery process and then help you build the RI portfolio right for your organization. If you would like to partner with us to develop a custom questionnaire, click here.

Read on to discover implementation considerations including performance, the spectrum of RI investing, levels of implementation and intentionality, discovering your organization's starting point, and measuring RI's impact.

While many investors express concern that RI strategies generate lower returns, several studies indicate otherwise.

|

|

|

Note: Only includes individual academic studies looking at securities and funds (i.e. no literature reviews or meta studies are included). Source: Fulton, Mark and Kahn, Bruce M, and Sharples, Camilla, Sustainable Investing: Establishing Long-term, Value, and performance (June 12, 2012). |

In comparing standard indices with their ESG indices counterparts, competitive performance is possible.

Incorporating Responsive Investing In Your Portfolio

|

| Source: FEG. |

|

Negative Screening |

Avoidance from companies or industries (ex. tobacco, gambling, pornography, abortifacients). |

|

Positive Screening |

Investing in specific sectors, companies, or projects with clear positive impact (ex. Identifying environment friendly company, clean technology, renewable energy, urban revitalization). |

|

Impact Investing |

Targeted investment aimed at solving social or environmental problems (ex. Bridge financing to local non profit organization, lending capital for revitalization). |

|

Thematic Investing |

Targeting specific strategies that mirror the values of the investor (ex. human rights, political contributions, economic development, etc.). |

|

Full ESG Integration |

Systematic and explicit inclusion of ESG criteria in the decision-making process to identify externalities and generate a better representative value of a company. |

|

Data Source: USSIF. |

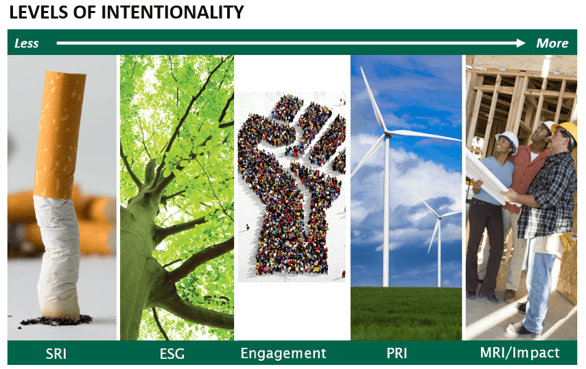

|

|

|

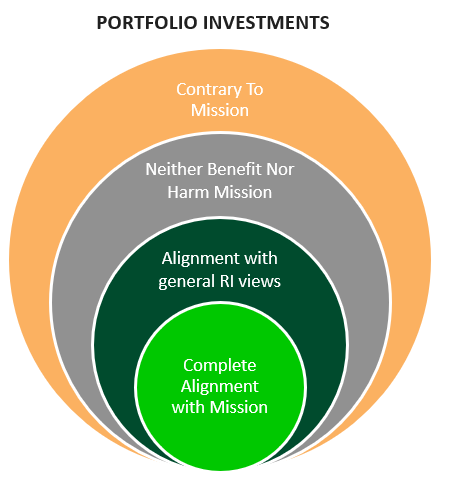

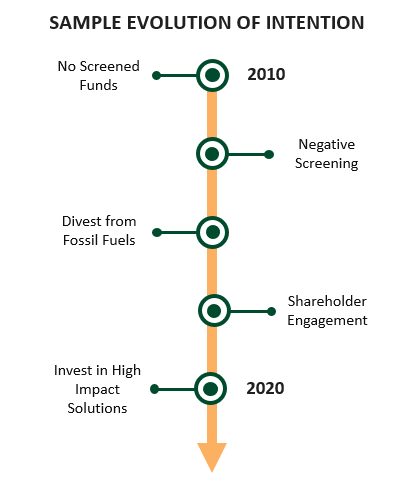

| Data Source: FEG. | Data Source: FEG. This is a hypothetical implementation based on intention and alignment to mission. |

ESG portfolio construction needs are viewed the same as any traditional portfolio. For example, focus on asset allocation, risk, manager selection, and security analysis.

When the discussion arises about RI, there are several considerations. To help set your investment goals and expectations, FEG will take a deep dive into the discovery process.

SAMPLE CONSIDERATIONS

| Objectives | Why are we considering RI? |

| IPS | Amend current IPS vs. develop separate ESG IPS |

| Portfolio | What level of intention? Slice of endowment v. other option |

| Enterprise | Governance – Board Approval Process Fundraising – new donor opportunity Risks – loss of some supporters |

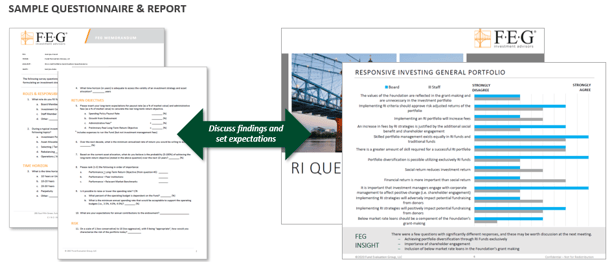

The sample survey below is one way we help ensure committee, board, and staff members are on the same page for your organization's needs and objectives. We develop a report that shares the results and helps to identify potential areas for discussion, or implementation.

|

| Source: FEG. |

|

FAITH BASED ORGANIZATION

|

|

|

HOLISTIC ORGANIZATION

|

|

|

ENVIRONMENTAL ORGANIZATION

|

|

|

|

| Source: UN SDG. https://www.un.org/sustainabledevelopment/sustainable-development-goals/ |

|

|

| Source: FEG. This is a hypothetical report card that an organization can utilize while selecting Responsive Investments. |

_with%20trademark-5.png)

© 2024 Fund Evaluation Group, LLC | 201 East Fifth Street Suite 1600 | Cincinnati, OH 45202 | 513-977-4400 | information@feg.com

Material is accurate as of this label date and no obligation nor intention to make updates or corrections exists.