We realize this week has been particularly volatile, and wanted to provide a few comments on the market volatility that has troubled market participants this week.

For over a decade, markets have benefited from low interest rates and valuations. Many may recall that the Federal Reserve (Fed) struggled to get inflation to reach its goal of 2%. Unfortunately, many droughts end with floods, and a flood of inflation has altered the outlook for interest rates and economic growth, impacting bonds, equities, and other assets.

For a more in-depth look, please read our latest Research Review, which highlights the Fed’s commitment to tamping persistent inflation and provides some color on the underlying market drivers.

If you have any specific questions, please get in touch with your FEG contact, or contact us here.

August Inflation Slightly Higher than Expected

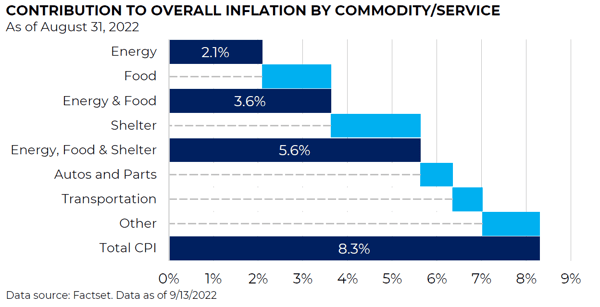

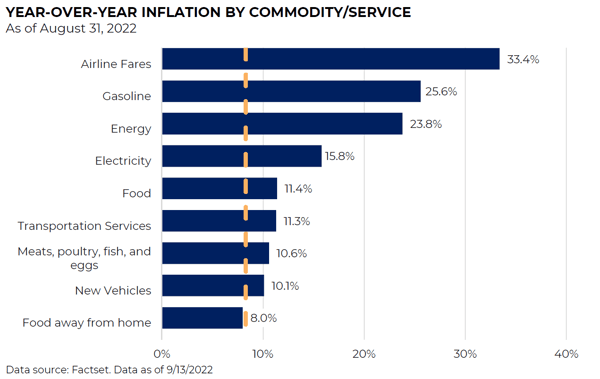

The August inflation print was expected to subside from previous levels and measure 8%, but instead, the headline print of 8.3% rattled markets amid evidence that the Fed’s fight is far from over. Investors had hoped that the low-rate, low-inflation environment would return in 2023, but recent inflation news shifted expectations farther into the future and elevated recessionary concerns.

The charts below provide a quick overview of what contributed to inflation and a breakdown by service.

Fed Rate Hike

- The recent inflation print likely settled the debate between a 50 basis point (bp) or a 75 bp hike with the Fed’s next move, with the market fully pricing in a 75bps hike at the end of the month. The Fed has entered its blackout period, so we are unlikely to see any direct commentary before the meeting. Although unlikely to come to fruition, some have argued that the recent inflation print may have put discussion of a 100 bps hike on the table.

- 2-year yields are approximately 3.8%, while the 10-year is creeping up toward 3.5%. Equities hit bottom in June when the 10-year peaked at 3.5% before retreating. The front end of the curve continues to price in a more hawkish Fed and a higher terminal rate.

- Credit ETFs are broadly down due to the movement in rates and risk-off direction in equities. Yields jumping has limited spread widening. High yield spreads near 450bps over Treasuries are well below the high of 600bps reached in June.

Impact on Equities

- Equity markets were disappointed with the news because persistent inflation gives the Fed more evidence to continue with rate hikes. Pro-cyclical demand that has pressured economies since the start of the pandemic has equity markets moving in conjunction with bond prices. In sum, higher rates equal lower equity prices. Declining interest rates spurred the recent equity market rally, but rising rates and inflation have unwound much of those gains.

- Growth and tech stocks continue to suffer amid higher rates. Higher rates especially hurt long-duration assets because the expected earnings of those stocks are well into the future, and higher rates mean higher discount rates for those future earnings, lowering current values. Value has performed well versus growth since the Jackson Hole meeting, where the Fed reiterated its goal of reducing inflation through higher interest rates, and its path continues with signs of persistent inflation.

- The significant rise in the dollar in response to the inflation news has negatively impacted non-U.S. equity investments for U.S. investors. Returns for international and emerging markets are much less negative when measured in local currency and often outperform U.S. equities.

FEG Insight

To conclude, we believe that market volatility is likely to continue as the Fed, and other central banks, battle inflationary pressures that are altering the market foundation that was in place for the last decade. In time, however, investors should find comfort knowing periods of such volatility present opportunities, and a long-term horizon allows investors to weather such storms.

DISCLOSURES

This report was prepared by FEG (also known as Fund Evaluation Group, LLC), a federally registered investment adviser under the Investment Advisers Act of 1940, as amended, providing non-discretionary and discretionary investment advice to its clients on an individual basis. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. Fund Evaluation Group, LLC, Form ADV Part 2A & 2B can be obtained by written request directly to: Fund Evaluation Group, LLC, 201 East Fifth Street, Suite 1600, Cincinnati, OH 45202, Attention: Compliance Department.

The information herein was obtained from various sources. FEG does not guarantee the accuracy or completeness of such information provided by third parties. The information in this report is given as of the date indicated and believed to be reliable. FEG assumes no obligation to update this information, or to advise on further developments relating to it. FEG, its affiliates, directors, officers, employees, employee benefit programs and client accounts may have a long position in any securities of issuers discussed in this report.

Index performance results do not represent any managed portfolio returns. An investor cannot invest directly in a presented index, as an investment vehicle replicating an index would be required. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.

Neither the information nor any opinion expressed in this report constitutes an offer, or an invitation to make an offer, to buy or sell any securities.

Any return expectations provided are not intended as, and must not be regarded as, a representation, warranty or predication that the investment will achieve any particular rate of return over any particular time period or that investors will not incur losses.

Diversification or Asset Allocation does not assure or guarantee better performance and cannot eliminate the risk of investment loss.

Past performance is not indicative of future results.

This blog is prepared for informational purposes only. It does not address specific investment objectives, or the financial situation and the particular needs of any person who may receive this report.